Bank of England Holds Interest Rates at 5% - Implications for Your Finances

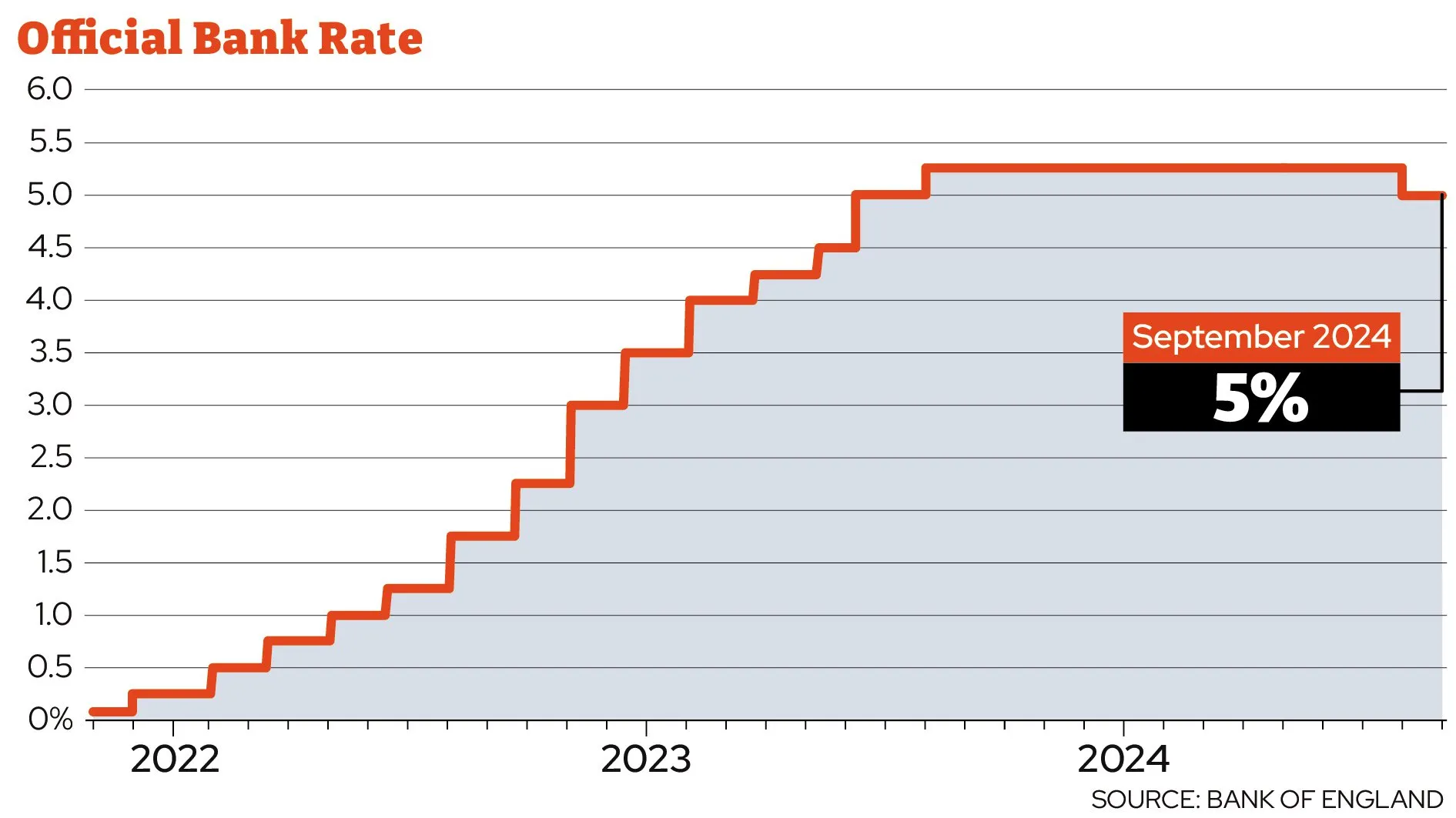

Bank of England Maintains Interest Rates at 5%

The recent decision by the Bank of England to hold interest rates at 5% comes as a significant development for both consumers and businesses. This decision by the Monetary Policy Committee (MPC) indicates a period of economic stability, yet its effects ripple through various financial areas.

Impact on Borrowing Costs

With these rates unchanged, borrowers can expect stable repayment amounts on loans and mortgages. Fixed-rate mortgages, in particular, remain unaffected, providing certainty for homeowners.

Influence on Savings

For savers, maintaining rates means interest income remains limited. Individuals may find yields stagnant, thus impacting savings growth over time. Financial planning becomes essential in this context.

Considerations for Investments

- Investment Strategy Adjustments: Investors may need to reconsider their strategies

- Market Reactions: Watch for shifts in financial markets

- Long-Term Projections: The current climate can shape long-term investment outlooks

Summary

In conclusion, the Bank of England's decision to hold interest rates at 5% shapes various facets of financial planning. Both borrowers and savers should assess their positions in light of this development. Stay informed and prepare to adapt your personal finance strategies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.