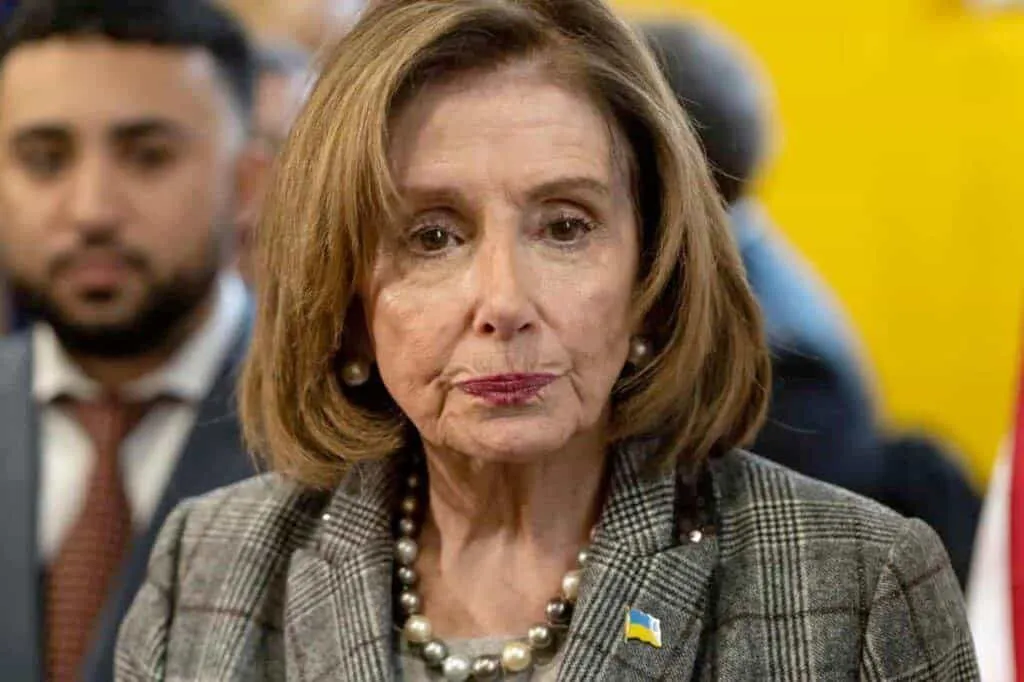

Investing: Nancy Pelosi's Troubling Stock Performance in Tesla

Investing and Nancy Pelosi's Journey with Tesla Stocks

Investing in stocks always carries inherent risks, and few exemplify this better than Nancy Pelosi's experience with Tesla (TSLA). Known as Congress's prime trader, her notable investments have occasionally turned sour.

Palo Alto Networks Loss

In 2024, Pelosi faced challenges with her Palo Alto Networks (PANW) investment. Initial purchases left her 23% down. Yet, her troubles deepened with Tesla, where she sold much of her position at a loss.

Details of the Tesla Investment

- Initial Purchase: Up to $6 million in TSLA through options contracts in 2020 and 2022.

- First Batch: Acquired on December 22, 2020, for approx. $1 million when shares were at $230.

- Second Batch: Worth up to $5 million from March 17, 2022, at about $300.

Despite the solid entry points, timing proved detrimental. For instance, she sold 5,000 Tesla shares in December 2022 at around $130, potentially netting only $650,000, far from her acquisition prices.

Future Prospects

Could there still be hope for profits? If TSLA rebounds, as many analysts predict, Pelosi's remaining shares might recover. Factors such as the success of upcoming projects like the Robotaxi event could influence growth.

Conclusion: The Impact of Investments

Understanding the risks in the stock market is crucial. Even experienced investors like Pelosi experience losses, emphasizing the need for prudent decision-making in investing.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.