Interest Rates Could Stay 'Permanently Higher' as U.S. Economy Remains Resilient

Economic Factors Influencing Interest Rates

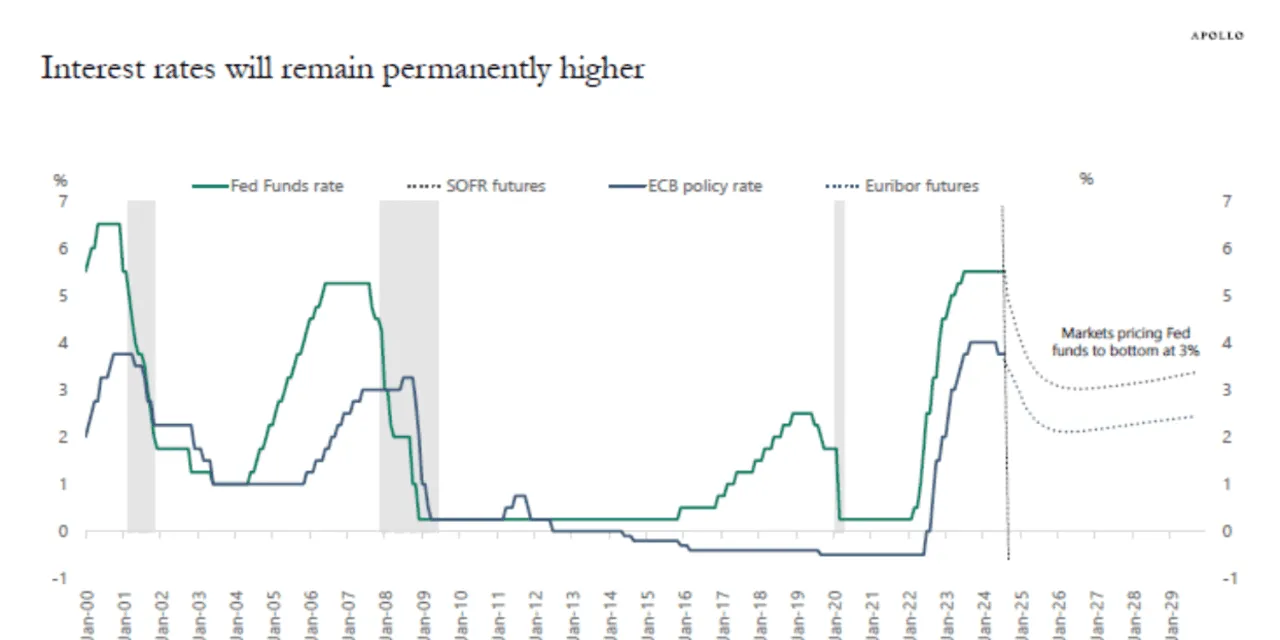

Interest rates are projected to stay 'permanently higher' due to several economic factors. A strong U.S. economy is pushing inflation rates up, causing uncertainty among investors.

Inflation and the Federal Reserve's Target

The Federal Reserve aims for a 2% inflation target, but recent trends indicate that achieving this goal might take longer than anticipated. Economic resilience is a double-edged sword, as it encourages spending but also escalates prices.

- Permanent higher rates may affect borrowing costs.

- Long-term impacts on the housing market...

- Potential effects on consumer spending and investment strategies.

Implications for Investors

Investors must remain vigilant as the landscape evolves. Understanding these trends is vital for effective portfolio management.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.