US Fed Rate Cut's Influence on Gold Prices, Stocks, Crude Oil, and Bonds

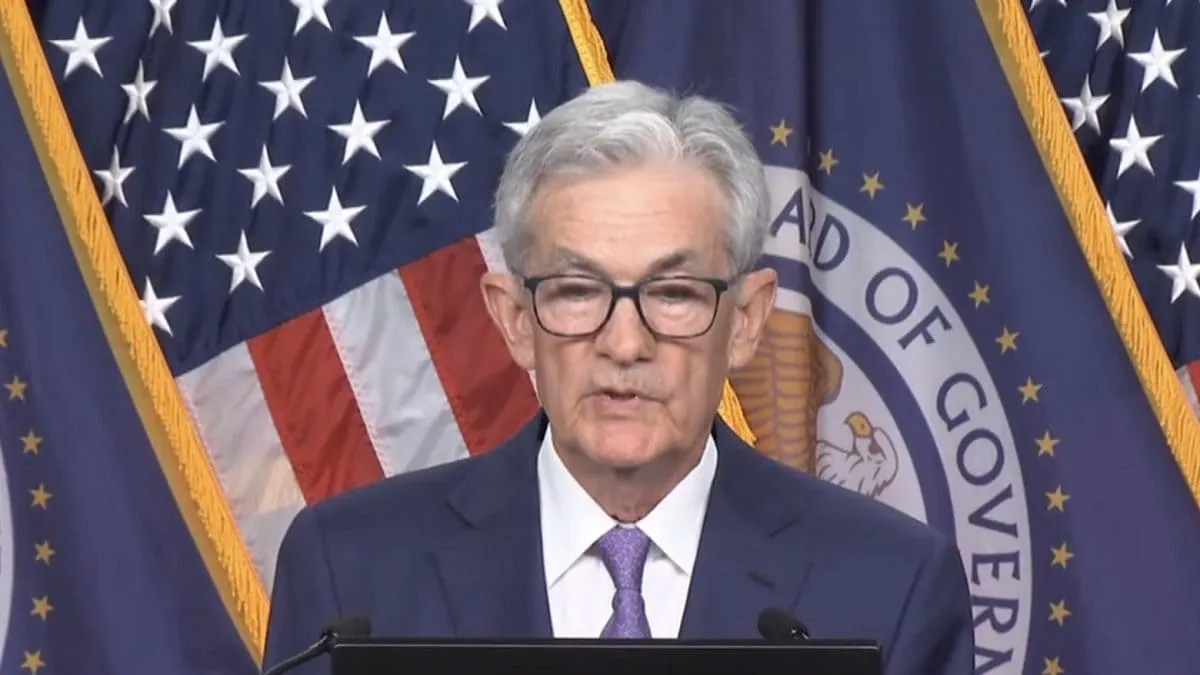

Overview of the US Fed Rate Cut

The US Fed rate cut has recently altered the financial landscape, implementing a half-point reduction to boost the economy.

Gold Prices Reaction

Post rate cut, gold prices have surged due to a weaker dollar and increased demand for safe-haven assets. The immediate response saw spot gold hitting record highs in international markets.

Factors Affecting Gold Prices

- *Lower opportunity costs* due to reduced interests

- *Weakening US dollar*

- Growth in *inflation concerns*

Stocks Outlook

Following the rate cuts, stocks are expected to experience growth as borrowing costs decrease. This prospect of increased business spending is reflected in rising markets.

Market Trends

- Benchmark indexes may rally as consumer confidence grows

- Indian markets already responding positively

Crude Oil Implications

The rate cut is likely to affect crude oil prices by initially weakening the US dollar, creating a less expensive market for foreign buyers.

Demand Dynamics

- Potentially increased *industrial consumption*

- Price volatility may continue due to geopolitical factors

Bond Market Reaction

Investors can expect a shift towards *long-duration bonds* as the rate cut cycle begins to influence markets.

Future Predictions

As highlighted by financial experts, the current environment indicates a strong demand for diversified asset classes following the US Fed rate cut.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.