Analyzing Political Risk: Treasuries, Brexit, and the 2024 Election

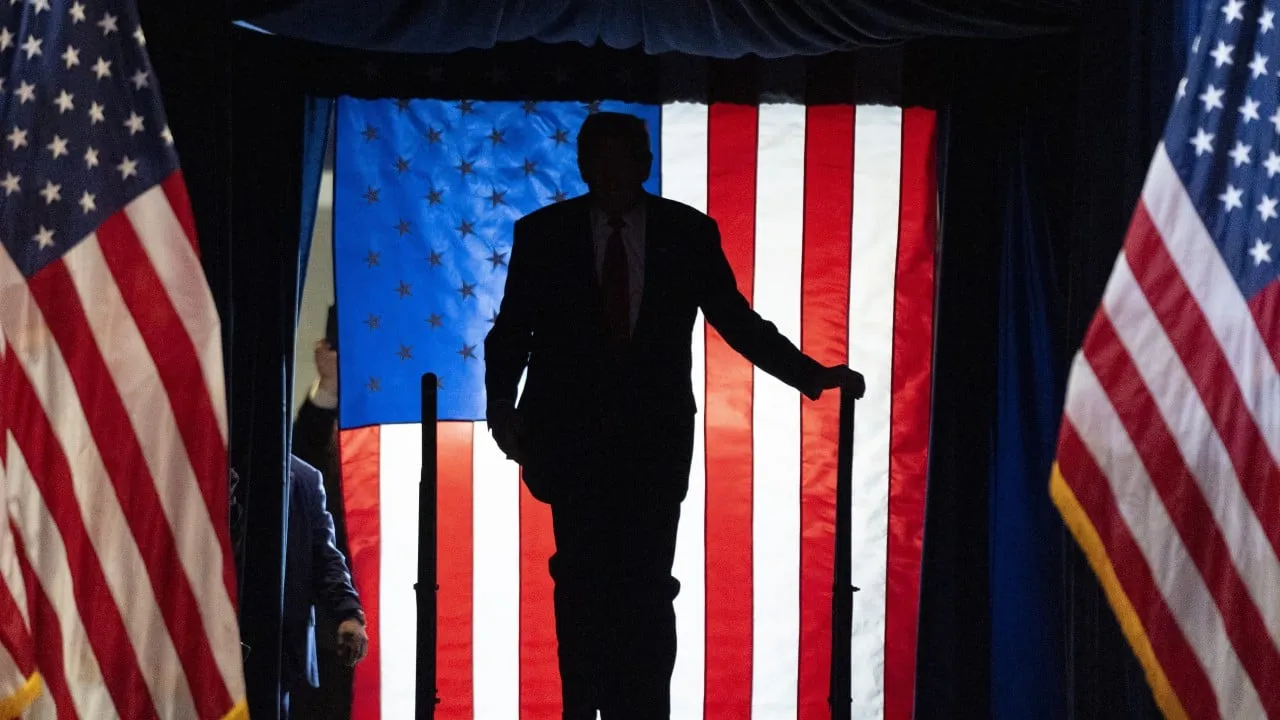

The Political Landscape Ahead of the 2024 Election

As the US approaches the 2024 election, political risks linked to the potential for unrest are intensifying. The markets appear to be disregarding the implications of political volatility, notably the lingering effects of the 2020 election. Investors are increasingly concerned about how political violence could manifest if election results are contested, especially if key swing states that could determine the outcome are involved.

The Role of Treasuries in Market Stability

US Treasuries have long been viewed as a safe haven, historically drawing investors even amid turmoil. However, rising political risk and the Federal Reserve's interest rate decisions may challenge this narrative.

- Debt Crisis: As debt levels rise and concerns about governance increase, the trust in Treasuries may falter.

- Interest Rates: Speculation surrounding the Federal Reserve's path forward can contribute to market volatility.

- Rule of Law: Questions surrounding the legitimacy of election results can exacerbate concerns.

Market Dynamics in Response to Political Uncertainty

Historically, markets have been slow to react to political risks. The US dollar's position as a reserve currency has lulled investors into a false sense of security. Yet, the erosion of governance becomes increasingly apparent, as seen in the recent downgrades by rating agencies. Investors need to consider at what point political dysfunction impacts asset prices.

- Monitoring political violence as an emerging risk.

- Assessing the implications of the 2024 election result on financial markets.

- Pondering the future of the US economy amidst rising tensions.

In summary, with escalating political risks, the sustainability of the US financial markets heavily relies on investor confidence. As we approach November's elections, it remains critical to evaluate how these dynamics intertwine with the broader economic landscape.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.