US Federal Reserves' Aggressive Cut on Interest Rates: A Focus on Inflation and Employment

Understanding the US Federal Reserves' Aggressive Rate Cut

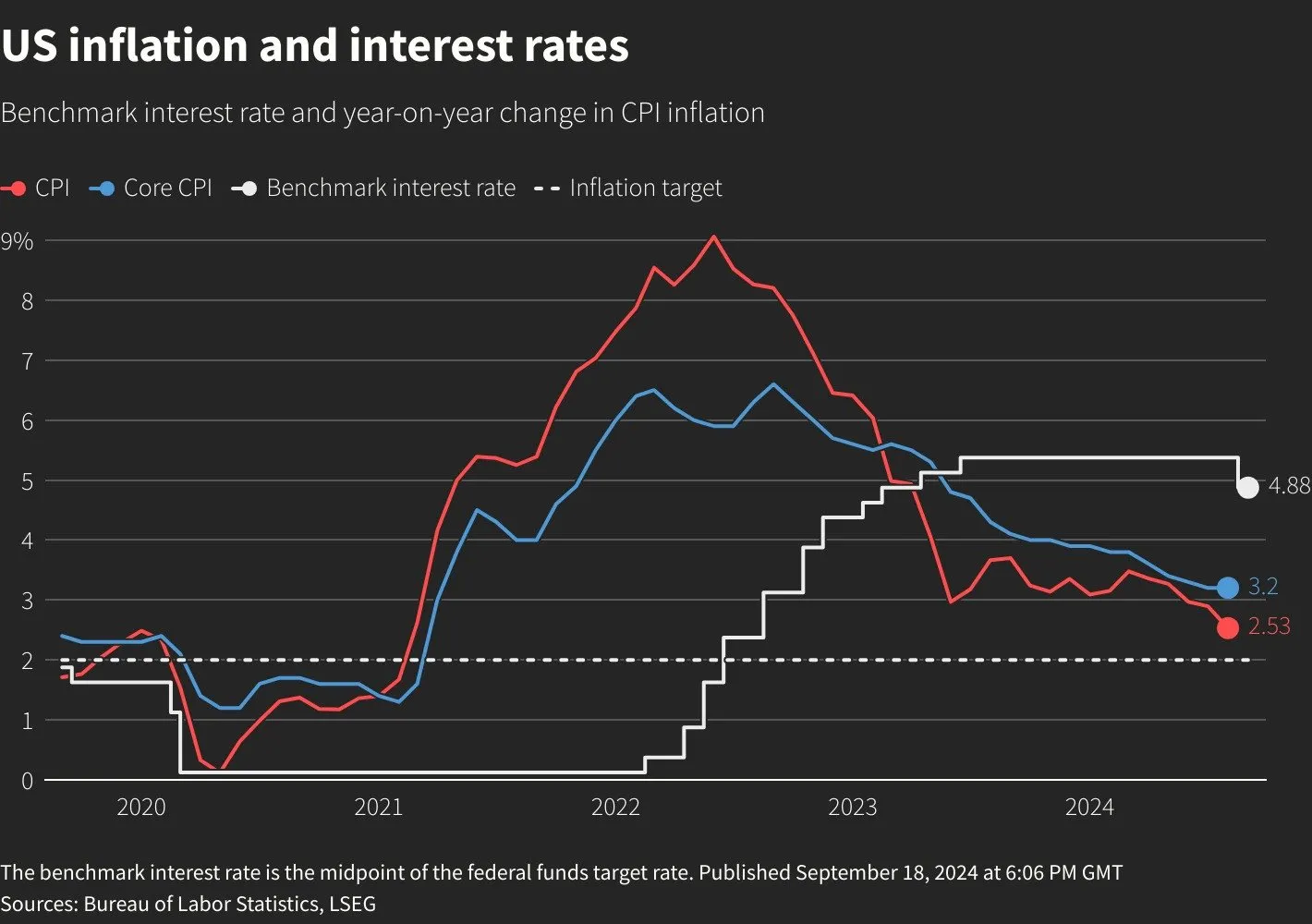

In a strategic move, the US Federal Reserves has announced an aggressive cut to interest rates. This decision aims to address the dual challenges of inflation and employment. Fed Chair Jerome Powell characterized this action as a vital recalibration of monetary policy.

Impact on Inflation

As inflation approaches the Fed's 2% target, Powell highlighted the importance of adjusting interest rates to stabilize the economy while avoiding major disruption.

Labor Market Considerations

- The employment report indicates ongoing strength.

- Powell described current labor conditions as favorable for economic growth.

- Lower interest rates aim to stimulate hiring and investment.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.