Federal Reserve Impacts Hong Kong's Interbank Market Amid Rate Cut Concerns

Global Financial Market Volatility: A Cautionary Tale

As the Federal Reserve implements a rate cut, Hong Kong's financial authorities are advising the public to proceed cautiously. HKMA's acting chief executive Howard Lee highlighted the potential for global financial market volatility during a recent briefing.

Understanding the Rate Cut Impact

- The Hong Kong Monetary Authority (HKMA) reduced the base interest rate to 5.25%, marking the first cut in four years.

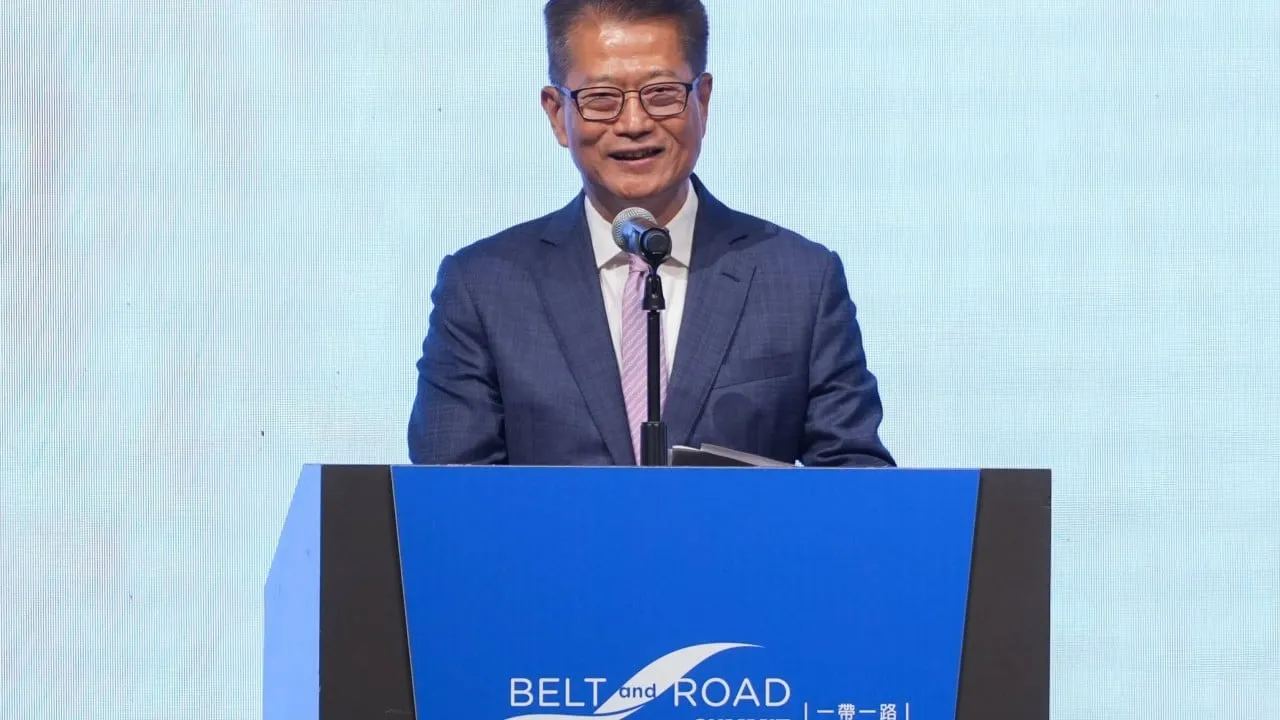

- Financial Secretary Paul Chan Mo-po noted that while commercial banks may follow suit with prime rate cuts, the adjustment pace might be slower compared to the US.

Factors Influencing Rate Adjustments

- US inflation values.

- Shifts in capital markets and stock market activities.

- Reactions of America's economy to ongoing rate changes.

Lee emphasized the importance of borrowers in Hong Kong to remain vigilant about interest rate risks especially when making decisions on property mortgages or other loans.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.