Fed Rate Cuts Impact on Stocks Near All-Time Highs

The Influence of Fed Rate Cuts

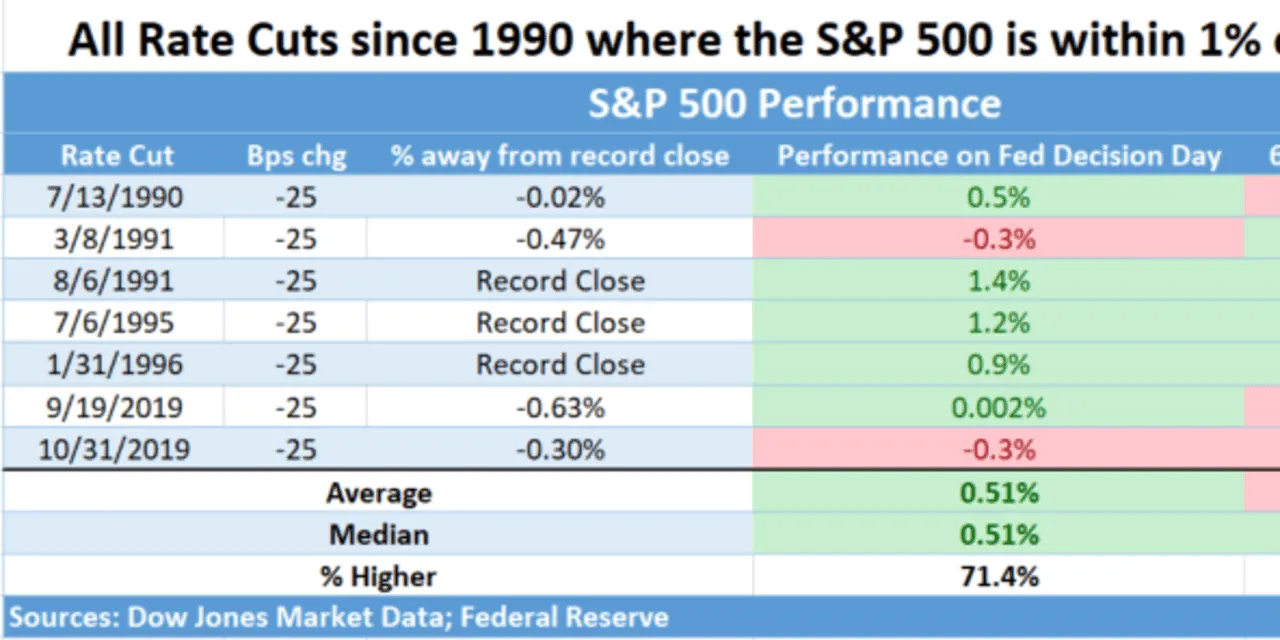

When the Federal Reserve implements rate cuts while the stock market is at or near all-time highs, it raises crucial questions for investors.

Historical Performance Data

- Since 1990, there have been seven occasions of rate cuts by the Fed with the S&P 500 either at its peak or within 1%.

- On the day of the Fed's announcement, stocks rose 71.4% of the time, with a median gain of 0.51%.

However, the performance over the following six months shows a mixed bag:

- 57.1% of the time, stocks continued to gain

- Median gains were relatively modest at 0.62%

Understanding the Broader Economic Context

Market analysts emphasize that the economic environment surrounding rate cuts plays a crucial role. Factors like inflation and employment rates significantly influence stock market trends.

Conclusion: What to Watch For

Investors should surely consider both historical data and current economic conditions before drawing conclusions about future market performance.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.