US Treasury EV Charger Tax Credit Guidance: Understand Your Eligibility

Detailed Insights on EV Charger Tax Credits

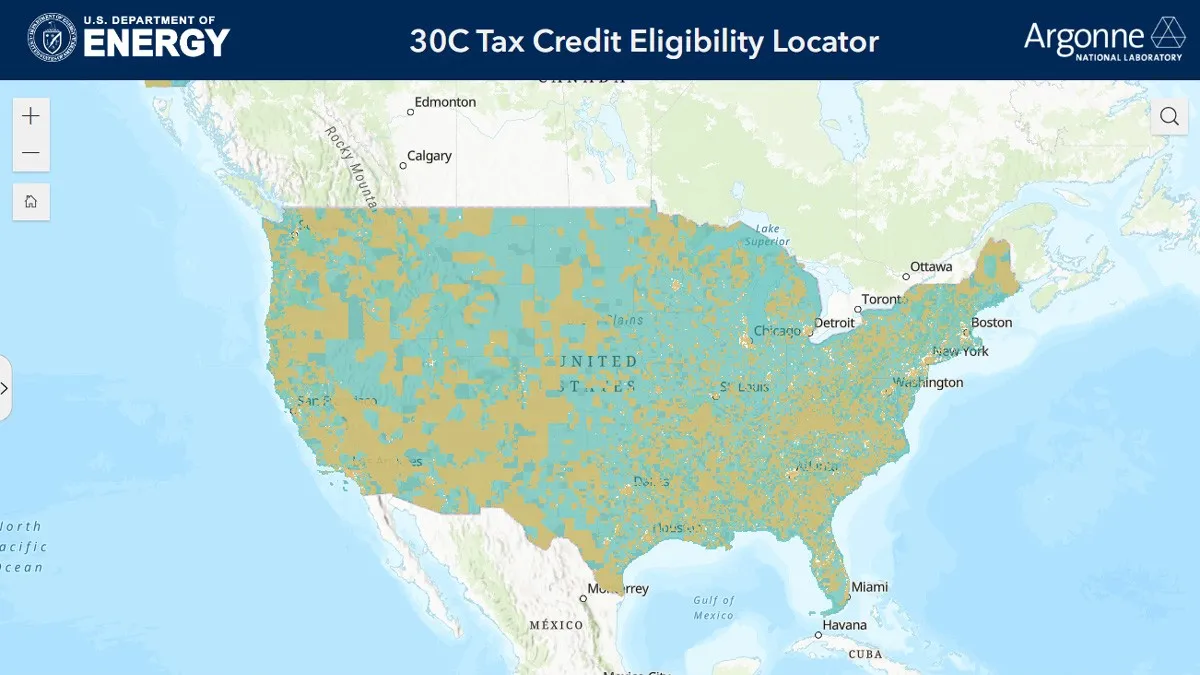

The US Treasury recently updated its guidance regarding tax credits for EV chargers, aiming to assist both individuals and businesses. Understanding eligibility criteria is crucial for those interested in benefiting from these incentives.

Essential Criteria for Eligibility

To qualify for the EV charger tax credit, applicants must meet specific conditions outlined by federal regulations. Key factors include:

- Installation location

- Type of charger

- Application submission timelines

How to Verify Your Qualification

Individuals should consult the official US Treasury guidance for precise eligibility requirements. Utilizing resources such as tax professionals can facilitate a smoother application process.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.