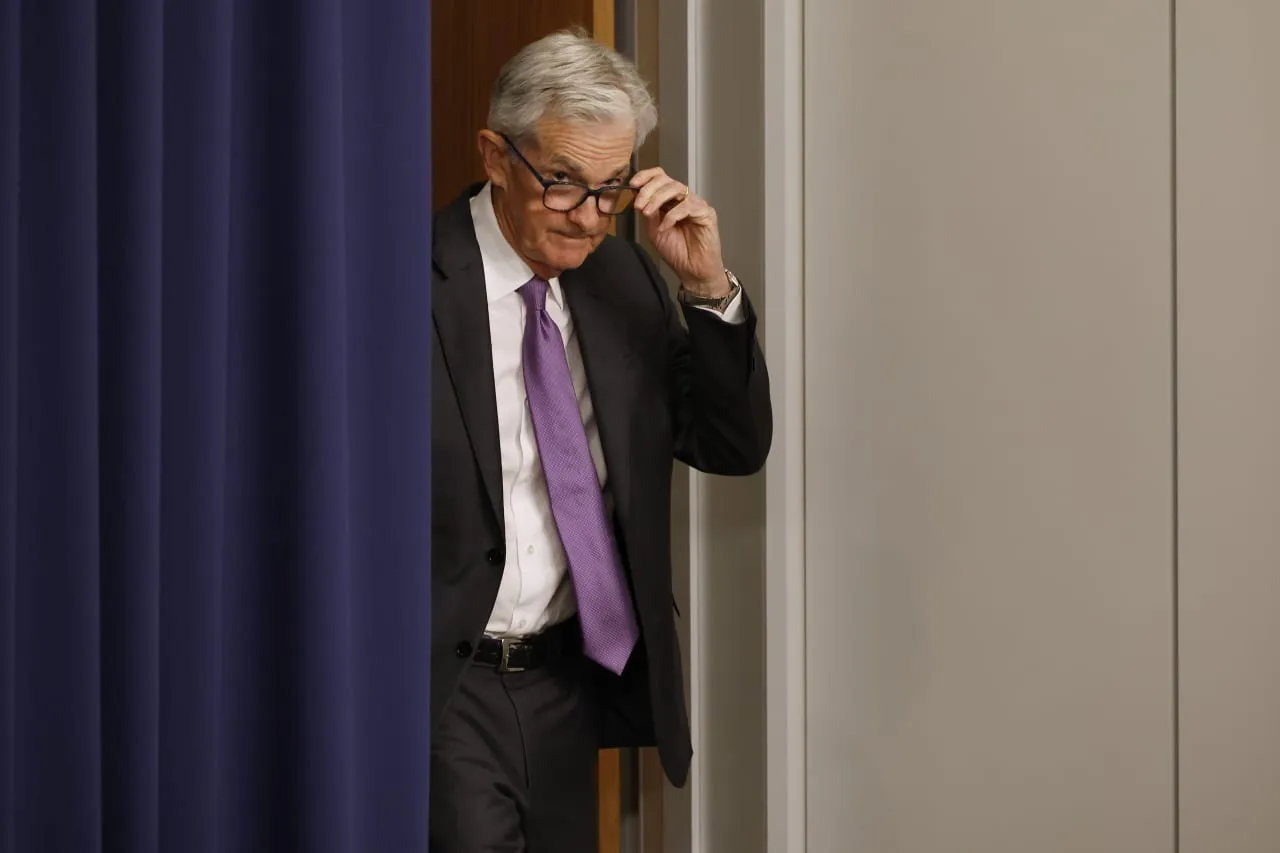

Banking Insights: Fed's Surprising Interest Rate Decisions Amid Economic Growth

Unpacking the Fed's Decision to Lower Interest Rates

As Wall Street anticipates a significant reduction in interest rates, many analysts find the scenario puzzling given the current economic performance indicators that suggest strong growth. However, the Federal Reserve's approach to monetary policy might reveal critical insights into future economic conditions.

Economic Growth vs. Interest Rates

Typically, a buoyant economy correlates with rising interest rates to prevent overheating. Yet, this cycle, characterized by:

- Labor Market Resilience: Unemployment rates remain low despite inflation concerns.

- Corporate Profitability: Many companies report healthy earnings, supporting a positive outlook.

- Global Economic Signals: Indicators from other economies suggest a need for more accommodative policies.

Monetary Policy Considerations

The Federal Reserve's strategies are proactive rather than reactive, focusing on long-term economic sustainability. As such, :

- Interest Rates Will Likely Decline: To stimulate spending and investment.

- Economic Predictions/Forecasts: Could shift towards a more supportive financial landscape.

Ultimately, the conjunction of banking dynamics and the central banking environment implies shifts that investors and markets must closely watch.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.