Stocks and Bonds: The Impact of Interest Rate Cuts on the US Economy

Tuesday, 17 September 2024, 17:00

Federal Reserve's Rate Cut and Market Reactions

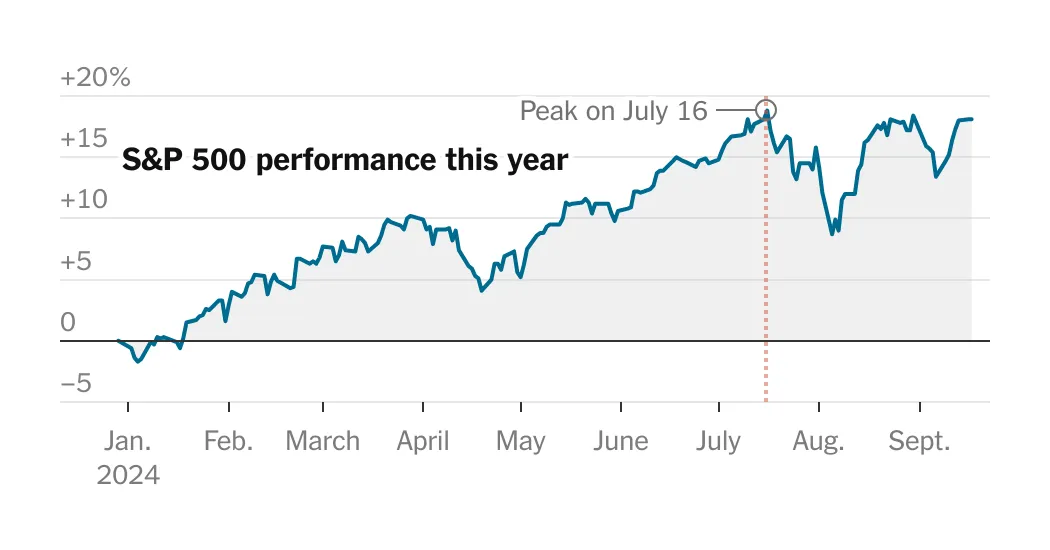

The outlook for stocks and bonds is pivotal as the Federal Reserve contemplates a major interest rate reduction. The S&P 500 and Nasdaq Composite indices are showing signs of optimism among investors. Observers are keen to see how these changes will influence the Russell 2000 and overall market performance.

Anticipating Economic Outcomes

- Tech stocks in the Nasdaq Composite are reacting positively to the prospect of lower rates.

- Investors believe a rapid response from the Fed can mitigate potential economic challenges.

- The impact on bonds is crucial as lower rates typically increase their attractiveness.

Investor Sentiment and Market Forecasts

- Market analysts expect strong rallies in stock valuations should interest rates decline.

- The US economy shows resilience, positioning Wall Street for a possible upward trend.

- Interest rates and market psychology are inextricably linked, shaping individual investment strategies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.