Debt Strategies: Wall Street's Bold Move into Private Equity Buyout Funding

Revisiting Debt: Wall Street's Buyout Strategy

After facing significant losses from hung debt, Wall Street banks are embracing private equity buyouts once again. With the lessons of previous financial turbulence still fresh, these financial institutions are strategically repositioning themselves in hopes of lucrative earnings. Observers like Jeremy Duffy and Elon Musk are keenly watching these developments, especially as the Federal Reserve continues to impact global markets.

The Market Dynamics of Debt and Earnings

- Wall Street's Resilience: Banks are regaining their confidence in buyouts.

- Federal Reserve's Role: Interest rates from the Fed are pivotal to this landscape.

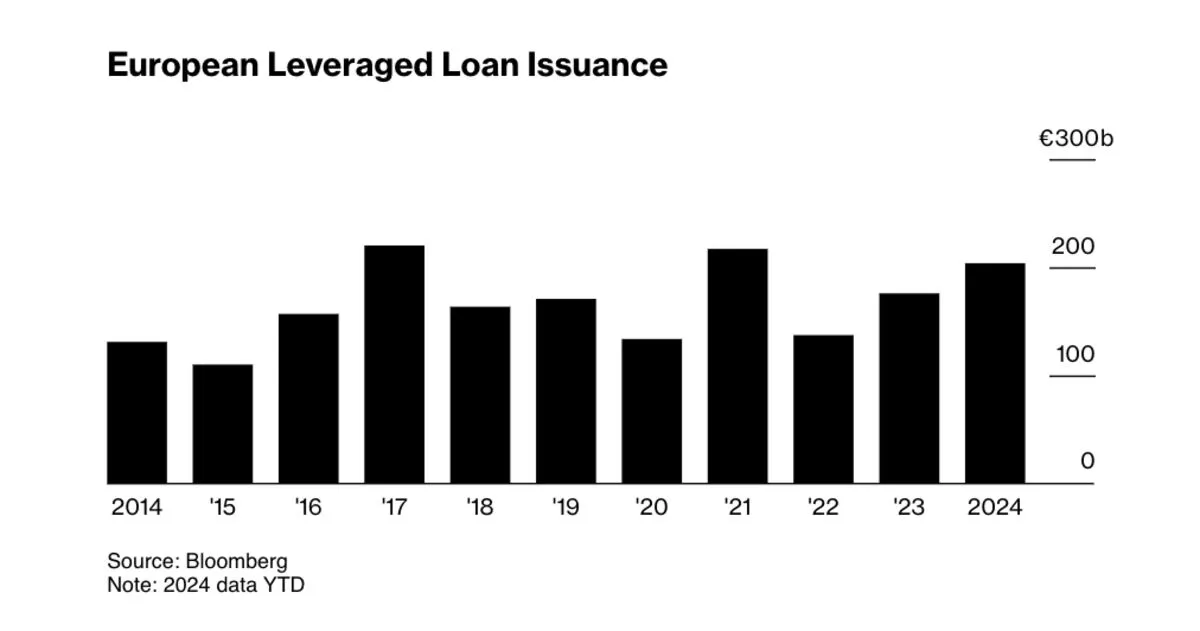

- Europe's Influence: Financial trends in Europe affect the strategy of U.S. banks.

As markets shift, investors will need to stay informed on how these changes will affect future strategies for managing debt.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.