The Resilience of Cash Holdings and Money-Market Funds Post Fed's First Rate Cut

Thursday, 4 April 2024, 16:47

The Impact of Cash Reserves Post Rate Cut

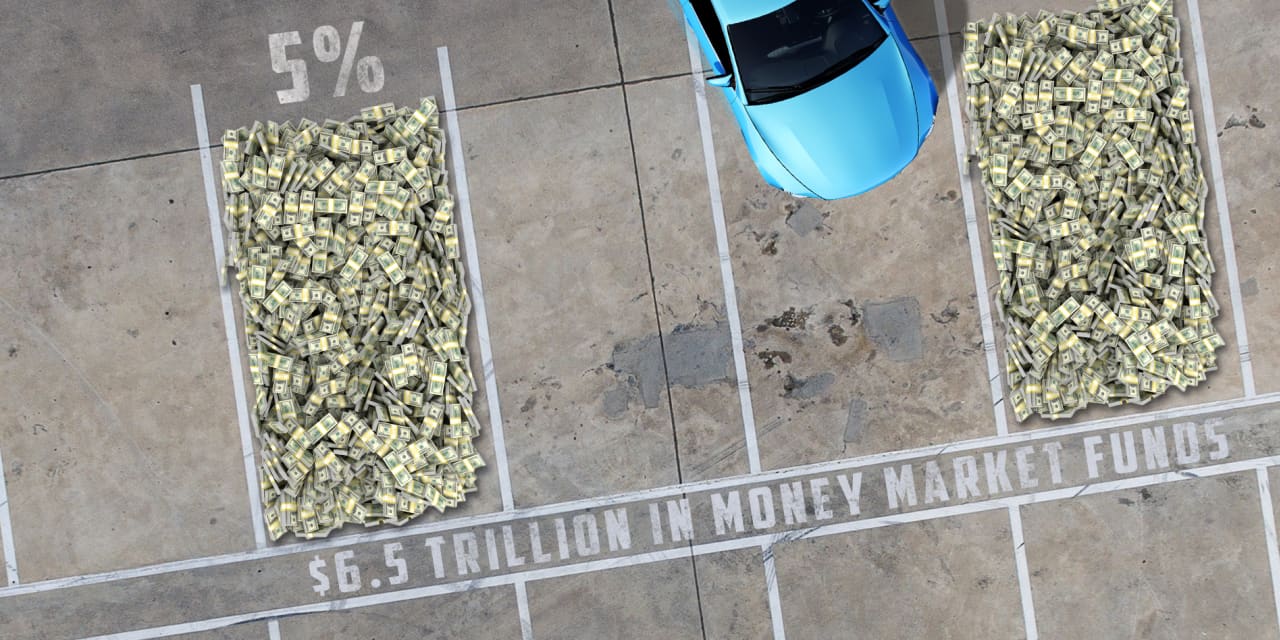

The record level of cash in money-market funds, offering a competitive yield of approximately 5%, is projected to endure despite the Federal Reserve's rate reduction.

Fed's Stance on Rate Cuts

Despite the slow pace of rate cuts mentioned by the Federal Reserve, the attractiveness of money-market funds may be maintained due to the stable monetary policy.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.