CGTMSE Credit Guarantee Scheme Now Offers 90% Coverage for Women MSMEs

Introduction to CGTMSE's Enhanced Support

The CGTMSE credit guarantee scheme is now set to provide a 90% credit guarantee for women-owned MSMEs under a collateral-free loan scheme. This initiative was announced by the MSME Ministry to bolster women's entrepreneurship.

Details of the Enhanced Scheme

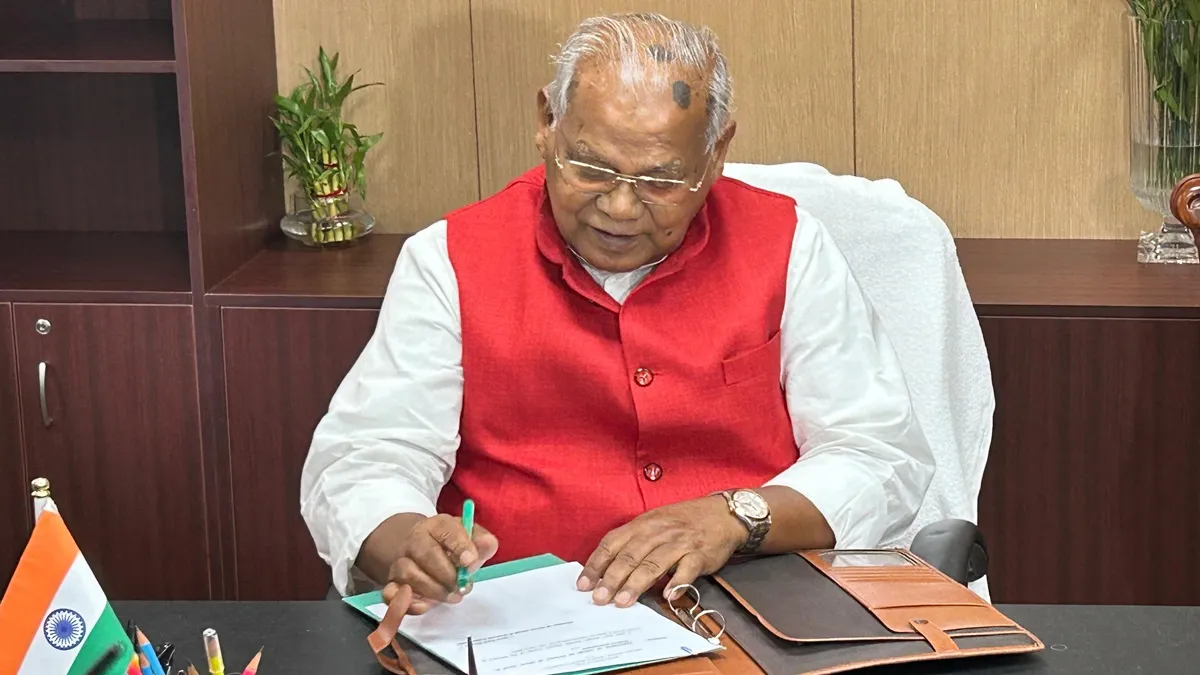

Women-led MSEs can expect to secure more favorable loan conditions due to this expansion. According to MSME Minister Jitan Ram Manjhi, this move is expected to aid 27 lakh women entrepreneurs.

Key Features of the Scheme

- Increased credit guarantee coverage to 90%

- Reduction in annual guarantee fees

- Aiming for credit guarantees worth Rs 5 lakh crore within two years

Benefits for Women Entrepreneurs

This scheme not only enhances financial accessibility but also aligns with the government's goals to support women in the MSME sector. Under the previous initiative, credit guarantees were capped at 85% for loans up to Rs 2 crore, which later expanded to Rs 5 crore.

Conclusion

This initiative promises to propel the growth of women-led MSMEs significantly, generating numerous employment opportunities and fostering economic participation.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.