Natural Resource Partners and Its Royalty Business Model (NYSE:NRP)

Exploring NRP's Royalty Model

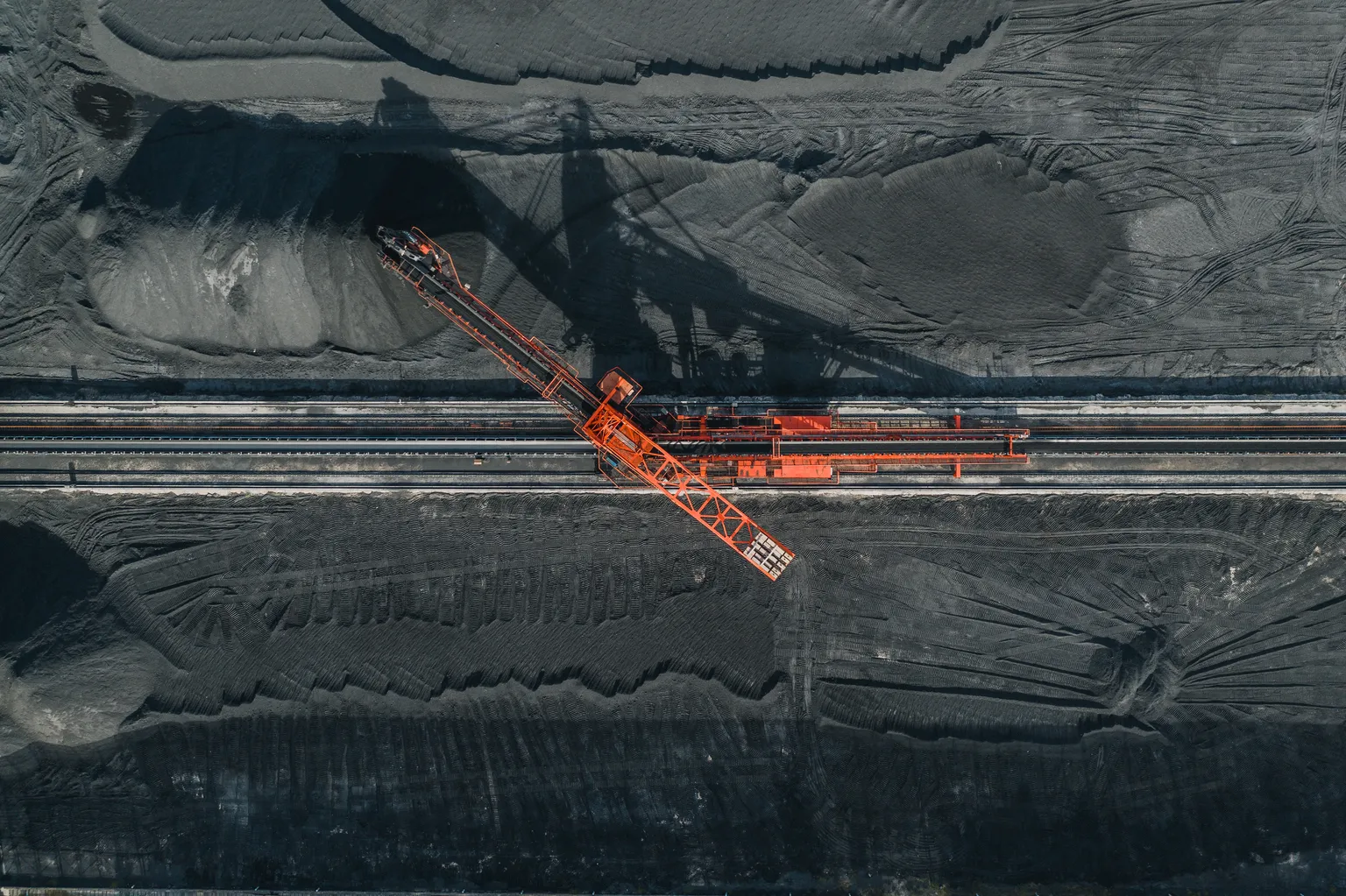

Natural Resource Partners (NYSE:NRP) has carved a niche in the energy sector by holding significant mineral rights across vast areas. With 13 million acres primarily in the Appalachia Basin and Wyoming, NRP collects royalty payments from coal lessees, making it a unique player in a traditional industry. This article explores how NRP navigates the complexities of royalty management.

Key Insights into NRP's Operations

- Mineral Rights Ownership

- Revenue Generation from Coal Royalties

- Strategic Positioning within Energy Markets

The Impact of Market Dynamics on NRP

Market conditions significantly influence NRP's performance, with fluctuations in coal demand affecting royalty incomes. Understanding these dynamics is crucial for potential investors.

The Future of NRP

As the energy landscape evolves, so does NRP's approach to managing and expanding its assets. Investors should keep an eye on how NRP adapts to these changes.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.