Personal Finance Insights on Fed Rate Cuts and Their Impact on Mortgage Loans, Credit Cards, and Other Areas

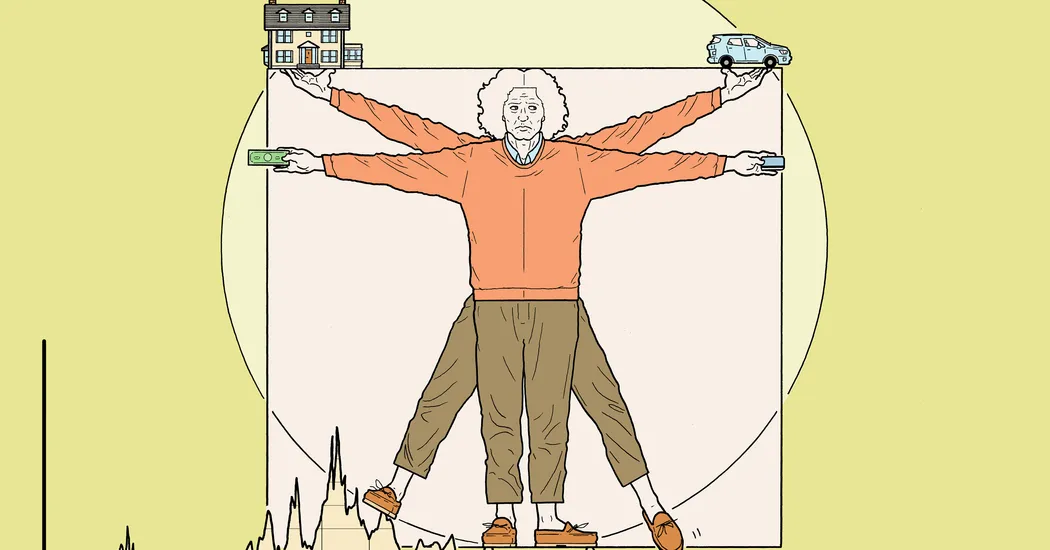

How Fed Rate Cuts Reshape Your Financial Landscape

The recent decision by the Federal Reserve to cut interest rates is poised to greatly influence various aspects of personal finance. Let's explore the immediate implications on mortgage loans, credit cards, car loans, savings, and student loans.

Impact on Mortgage Loans

The most profound effect will be seen in mortgage loans. Lower rates will make home financing more accessible, fostering a favorable market for potential buyers. As rates drop, refinancing becomes increasingly attractive, allowing homeowners to lower their monthly payments.

Credit Cards and Interest Rates

With interest rate reductions, credit card holders can anticipate lower fees on outstanding balances. This shift could enable individuals to pay off debts more efficiently, improving overall financial standings.

Implications for Cars and Student Loans

- Car loans: Expect more competitive rates, making vehicle purchases less burdensome.

- Student loans: Lower interest will benefit new borrowers, easing the burden of education financing.

Savings Trends

While borrowing becomes cheaper, savings might decrease as rates on savings accounts could decline too. This will lead to altered strategies in saving and investing.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.