Impact of Interest Rates Cut by the Federal Reserve System on Personal Finances

Interest Rates Cut by the Federal Reserve: An Overview

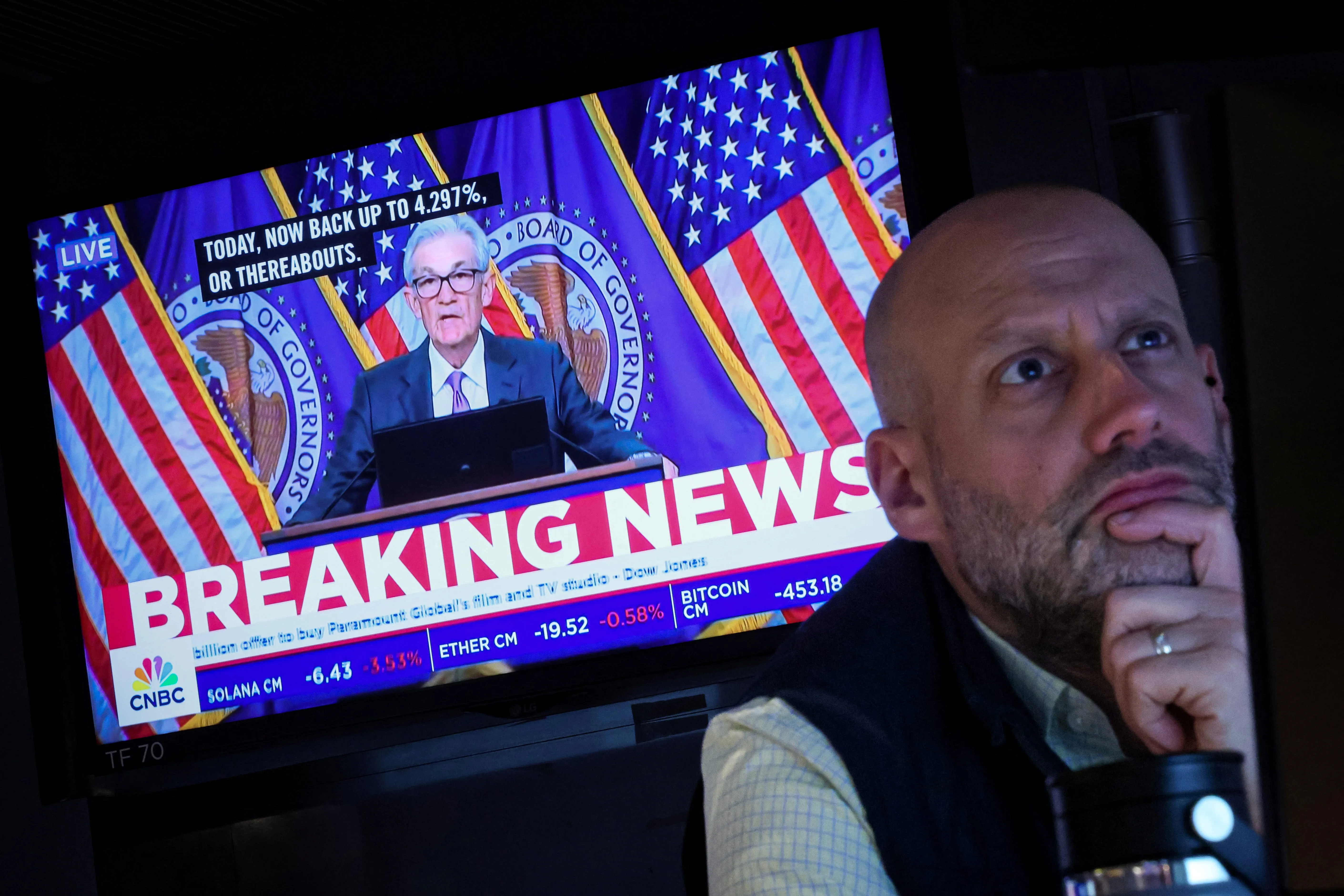

The Federal Reserve System is expected to cut interest rates this week. This decision holds significant importance for American consumers.

Effects on Loans and Credit Cards

A reduction in interest rates often lowers the costs of loans, making borrowing more affordable. This includes credit cards, where lower rates can directly impact monthly payments.

Influence on Personal Savings

While low rates can be favorable for borrowing, they typically yield lower returns on personal savings, leading to potential changes in saving behavior.

Investment Opportunities

Investors may find that an interest rate cut could boost stock markets like the S&P 500 and NASDAQ-100, as lower rates often drive investment in equities and increase market liquidity.

Mortgage Implications

For those considering mortgages, lower interest rates often lead to more favorable refinancing options, allowing homeowners to save on their monthly payments.

Final Thoughts on the Rate Cut

Overall, an interest rate cut by the Federal Reserve might have a neutral overall impact on the economy, but individuals should be prepared to adapt to these changes. For more in-depth insights on this topic, consider visiting resources like Bankrate.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.