Implied Volatility: An Objective Approach to Understanding Market Expectations

Implied Volatility: Key Indicator

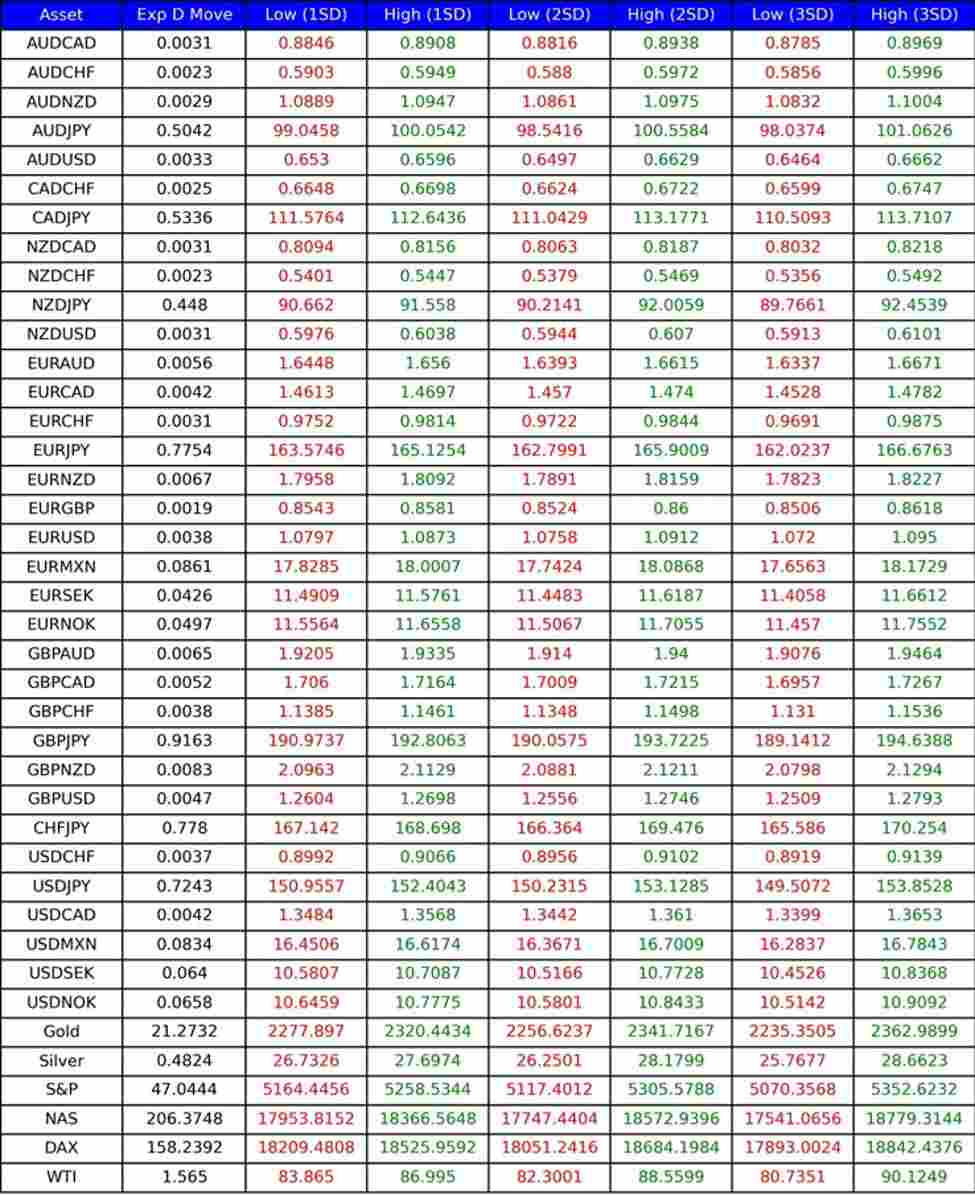

The post delves into the importance of implied volatility in determining market expectations and price swings. Implied volatility levels, based on 1-month data, act as dynamic support and resistance points for traders.

Market Expectations and Objective Analysis

- 68.2% Chance: Prices stay within 1 standard deviation

- 95.4% Chance: Prices stay within 2 standard deviations

- 99.6% Chance: Prices stay within 3 standard deviations

While these probabilities assume a normal distribution, implied volatility offers an objective price range complementing subjective analysis. By combining it with technical tools, traders can identify entry and exit points with confidence.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.