30-Year Mortgage Rates Reach Historic Low – Trends and Implications

Overview of Current Mortgage Rates

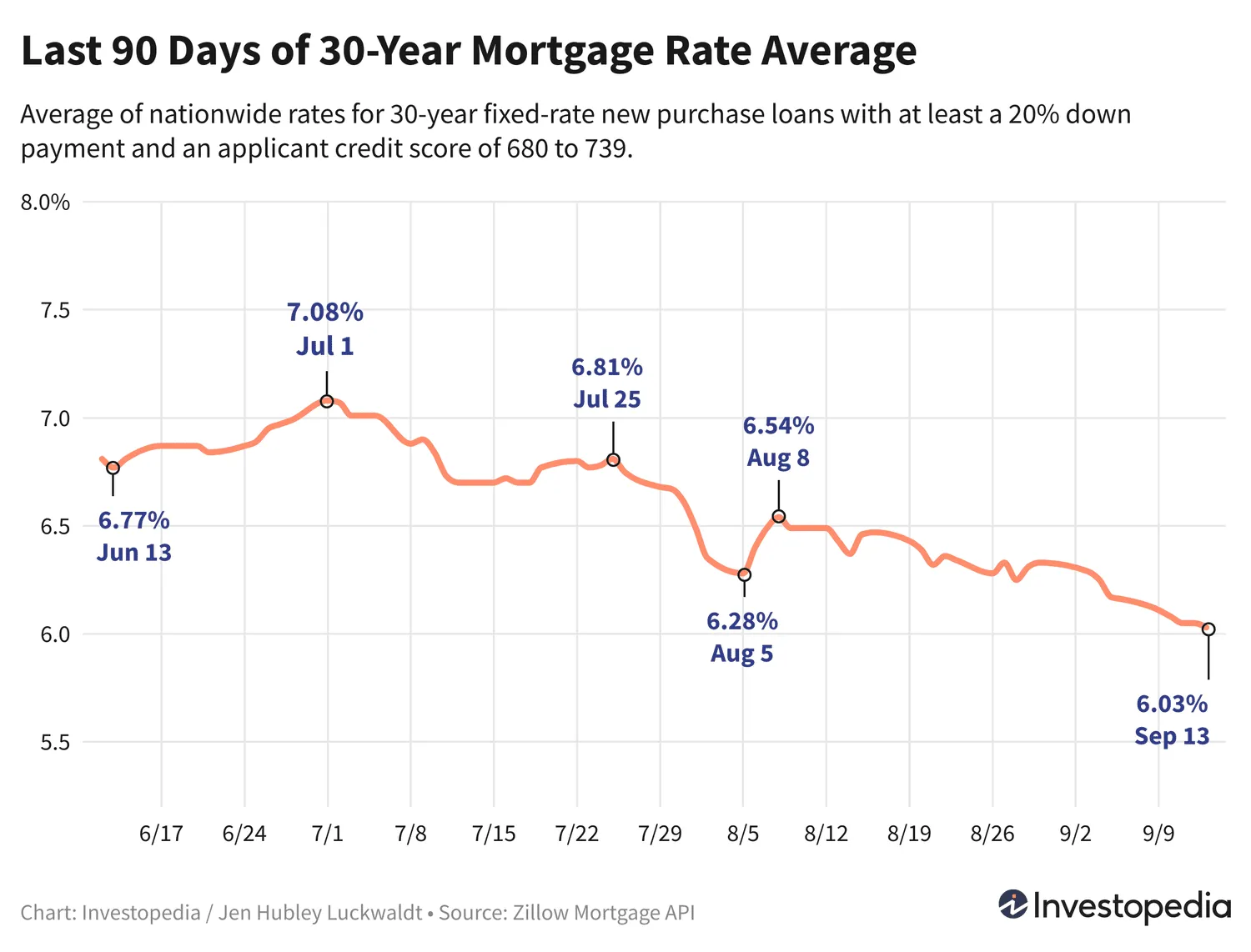

The recent drop in 30-year mortgage rates to a new 19-month low signifies a pivotal moment for home financing. As of September 16, 2024, buyers are benefiting from lower costs, encouraging a potential surge in the housing market.

Factors Contributing to Rate Declines

- Economic Indicators: Recent economic shifts have facilitated lower interest rates.

- Market Demand: A change in consumer behavior towards housing investments has influenced rates.

- Federal Policies: Adjustments in federal monetary policies have contributed to the rate drop.

Impact on Home Buyers

The decrease in both 30-year and 15-year mortgage rates presents an opportunity for buyers. This trend may motivate potential homeowners to act sooner rather than later.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.