Swiss CPI March Data: Expectations, Risks, and Market Implications

Swiss CPI March Data: Expectations and Risk Analysis

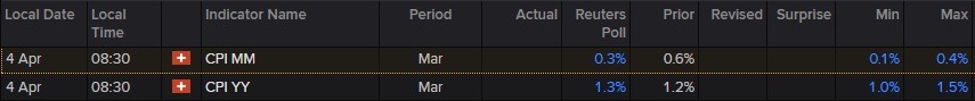

We have Swiss CPI for March due at 06:30 GMT. Markets are expecting a MM print of 0.3% (prior 0.6%) and a YY print of 1.3% (prior 1.2%).

Despite the surprise cut by the SNB at their previous meeting, I think there are two-way risks for the CHF on this print. The SNB refrained from providing forward guidance on rates and did not indicate a preference for a weaker CHF.

Market Insight and Positioning

- CHF CFTC data shows a decent short position, suggesting market sentiment.

- An unexpected outcome could trigger position unwinding based on the deviation from expectations.

Watch out for numbers such as a miss of 0.9% or lower for potential CHF downside or a print of 1.5% or higher for unwinding of short positions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.