Federal Reserve Chair Powell's Remarks and ISM Price Data Influence Economic Landscape

Wednesday, 3 April 2024, 21:18

Fed Chair Powell's Insights on Economic Landscape

Federal Reserve Chair Powell's recent comments emphasized the central bank's cautious stance on adjusting interest rates, with a focus on upcoming policy adjustments and economic evolution.

Impact of ISM Price Data on Markets

The release of ISM price data revealed easing inflationary pressures, reflecting softer demand and activity levels in the service sector.

Market Response to Powell's Speech and ISM Data

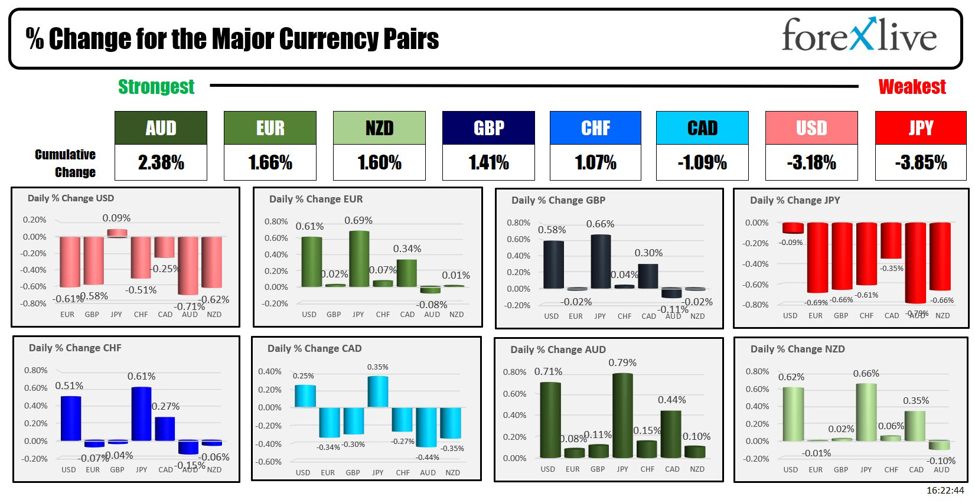

- The USD and yields experienced fluctuations following Powell's remarks and the ISM report, impacting market sentiment and investment decisions.

- Powell's insights on inflation, interest rates, and economic risks provided clarity and reassurance to investors, influencing future market trends.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.