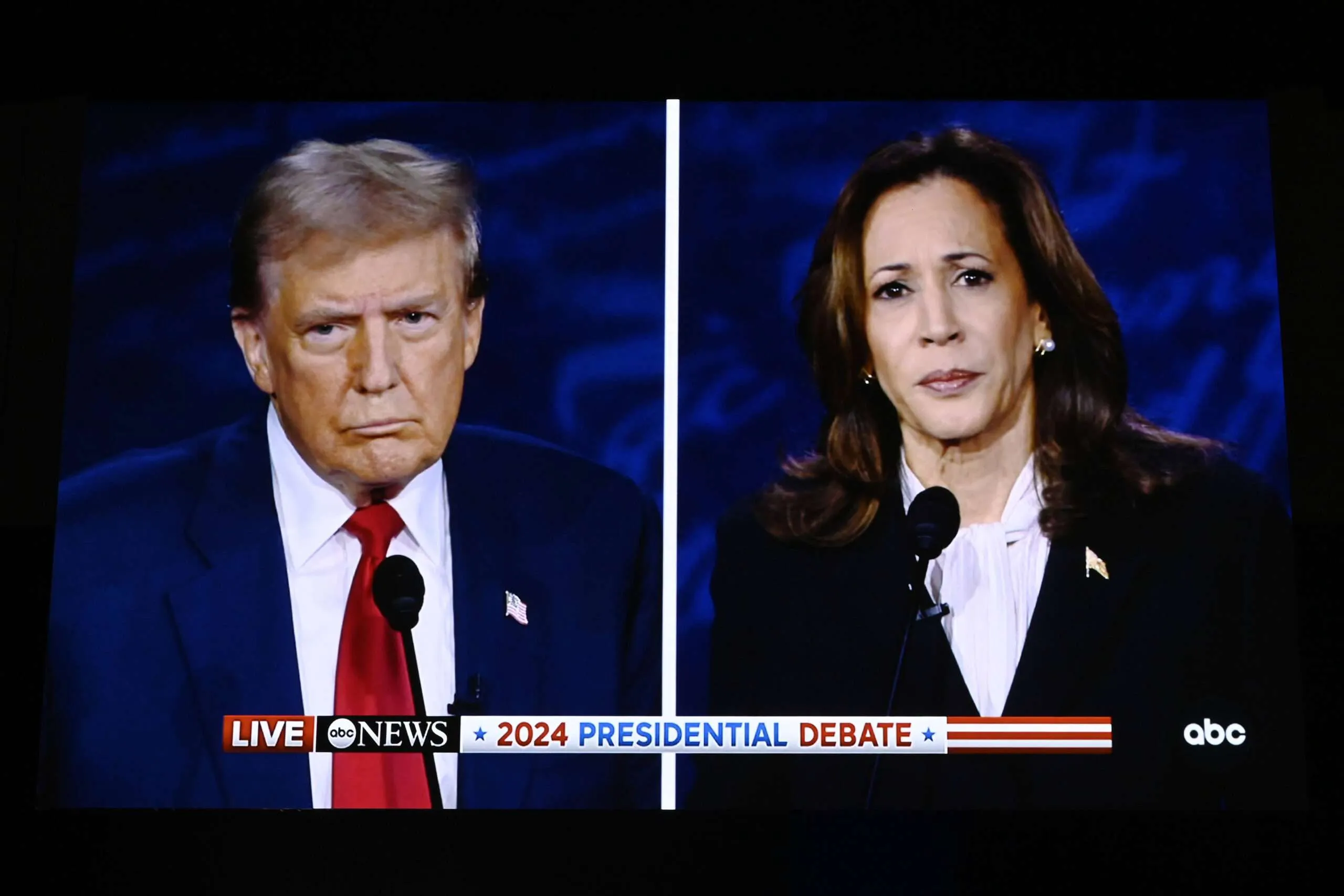

Big Government and Your Taxes: Donald Trump vs. Kamala Harris

Impact of Big Government on Taxes

The looming question as we approach the 2024 presidential election is how big government under Donald Trump and Kamala Harris will affect your taxes. With the national debt forecasted to soar, it’s crucial to analyze each candidate's approach to tax policy.

Trump's Tax Policies

Donald Trump has suggested tax reductions aimed at stimulating economic growth and reducing national debt burdens. His proposals emphasize cutting corporate taxes and simplifying tax filings to boost compliance.

Potential Outcomes

- Reduced Tax Burden: A priority to lessen taxes on businesses can lead to increased employment.

- Polarized Reactions: Trump's approach has met mixed responses from various economic analysts.

Harris's Tax Strategy

Kamala Harris champions a more progressive taxation strategy aimed at higher earners to fund social programs. Under her proposals, some argue that the trajectory of national debt won't improve significantly.

Projected Fiscal Landscape

- Increased Revenue: Harris seeks to generate higher tax revenues through increased rates for the wealthy.

- Concern for Small Businesses: Critics worry about how these plans could affect small businesses and job creation.

Conclusion: Voter Awareness

As voters consider their choices and the potential impact of big government policies on their taxes, understanding the differences between Trump and Harris is essential.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.