Death Cross Emerges in Micron's Stock Chart After Two Years

Understanding the Death Cross in Micron's Stock

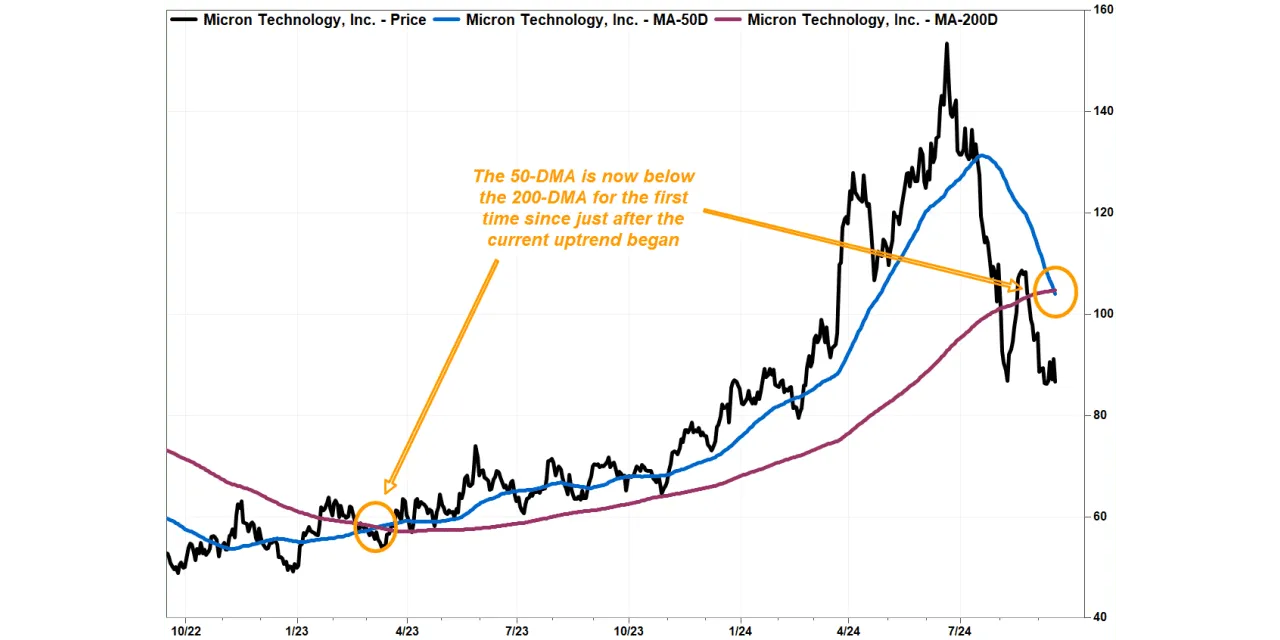

Micron's stock has presented a grave signal that may alert market watchers and investors alike. The formation of a death cross, where the 50-day moving average dips below the 200-day moving average, indicates a potential future decline in stock price. This pattern hasn't emerged for two years, accentuating its significance in current trading.

Market Implications of the Death Cross

The recent death cross seen in Micron's stock could lead to increased selling pressure as trend-following investors take caution. Historically, these signals often precede further downturns, raising concerns about future performance.

Investing Strategy Moving Forward

- Investors should monitor closely for signs of upward movement in the next few trading sessions.

- Consider diversifying portfolios to mitigate risks associated with potential declines.

- Stay informed about Micron's upcoming earnings reports which may influence stock direction.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.