Constellation Brands Set to Achieve New Heights in FY24 - Bright Prospects for Earnings

Overview

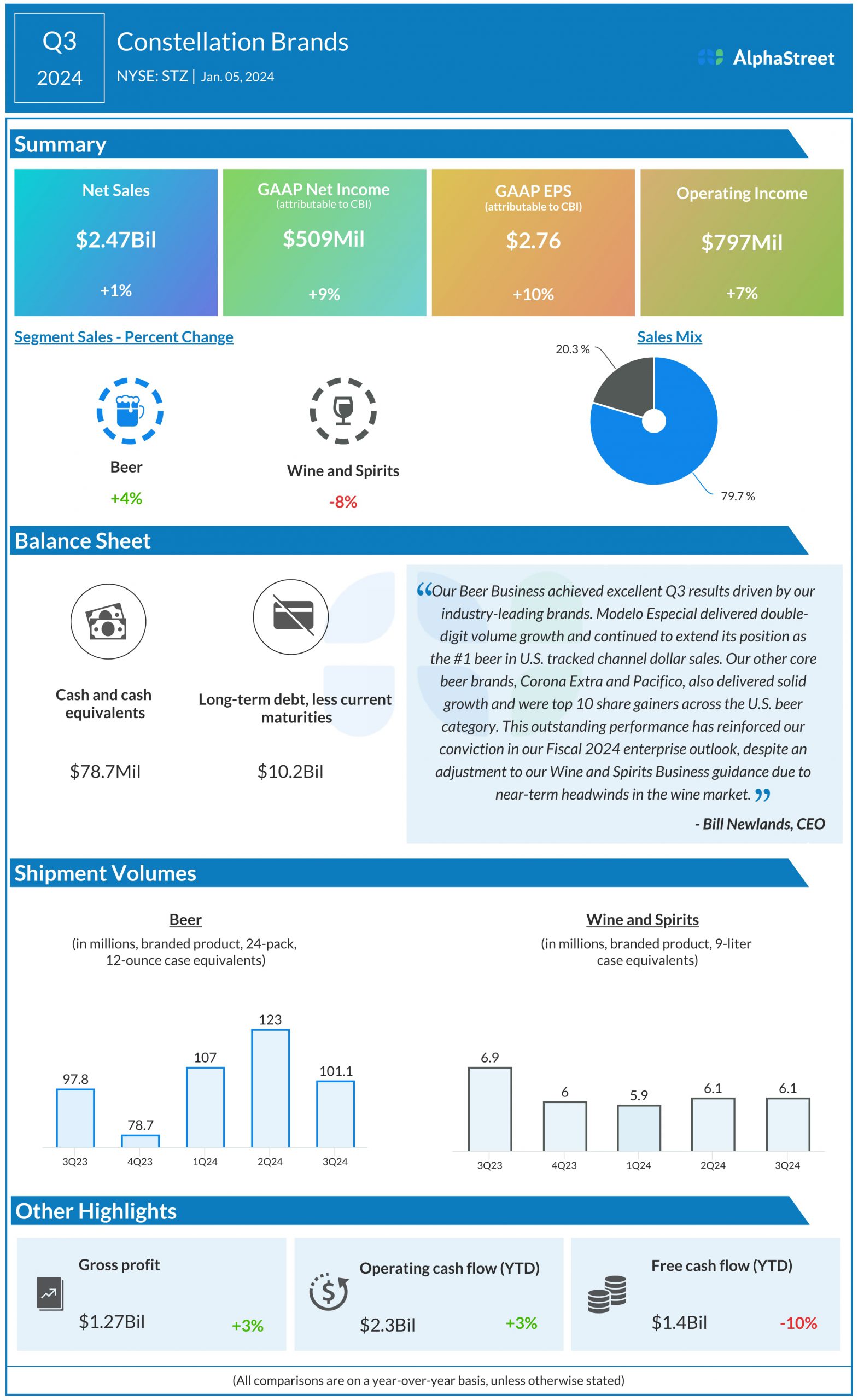

Constellation Brands, Inc. (NYSE: STZ) has maintained stable sales and profitability in recent years, with a focus on its thriving beer business amidst weakness in the wine and spirits segment. The upcoming fourth-quarter earnings report is expected to reflect the company's resilience and growth trajectory.

Financial Performance

The company's stock has witnessed an 8% increase in the past 30 days, reaching an all-time high, indicating strong market confidence. Analysts project a profit of $2.09 per share for Q4, showcasing an improvement over the previous year, with net sales expected to rise by 5% year-over-year.

Strategic Initiatives

- Revitalizing Wine and Spirits Segment: Management is focused on reviving the wine and spirits segment through portfolio evolution and cost-efficiency measures.

- Cash Flow Management: Constellation Brands maintains a disciplined capital allocation strategy and prioritizes shareholder returns through buybacks and dividends.

CEO Outlook

Bill Newlands, CEO of Constellation Brands, emphasizes the company's strong performance in the beer business, expressing optimism about fiscal '24 growth projections. He highlights the effective marketing strategies driving growth and shareholder value.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.