Tax Refunds: Analyzing Your Potential Surprise Tax Bill

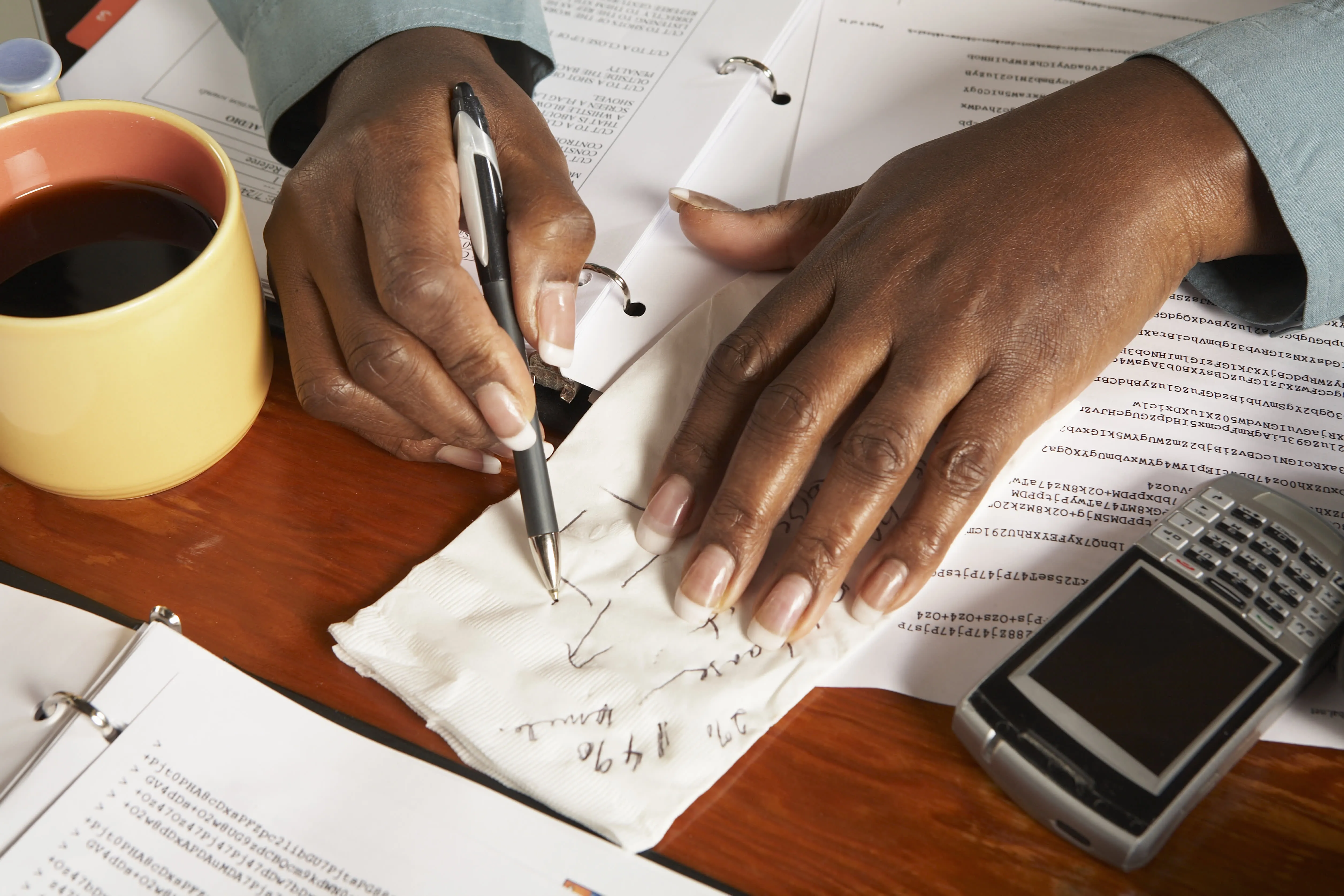

Understanding Tax Refunds and Potential Tax Bills

Tax refunds play a crucial role in personal finance, yet many fail to predict a surprise tax bill. Calculating your tax obligations early can save you from financial strain later. Experts emphasize the importance of reviewing your tax situation, especially with any changes in income or investment strategy that may affect your liabilities.

How to Calculate Your Tax Position

- Determine your total income for the year.

- Evaluate your withholding from each paycheck.

- Consider any deductions that apply.

- Assess potential tax refunds based on IRS guidelines.

Taking these steps ensures that you stay informed about your potential tax outcomes and can adjust your saving strategies accordingly.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.