Quick Snapshot of Expected Interest Rate Changes for Major Central Banks

Central Banks Interest Rates Expectations Snapshot

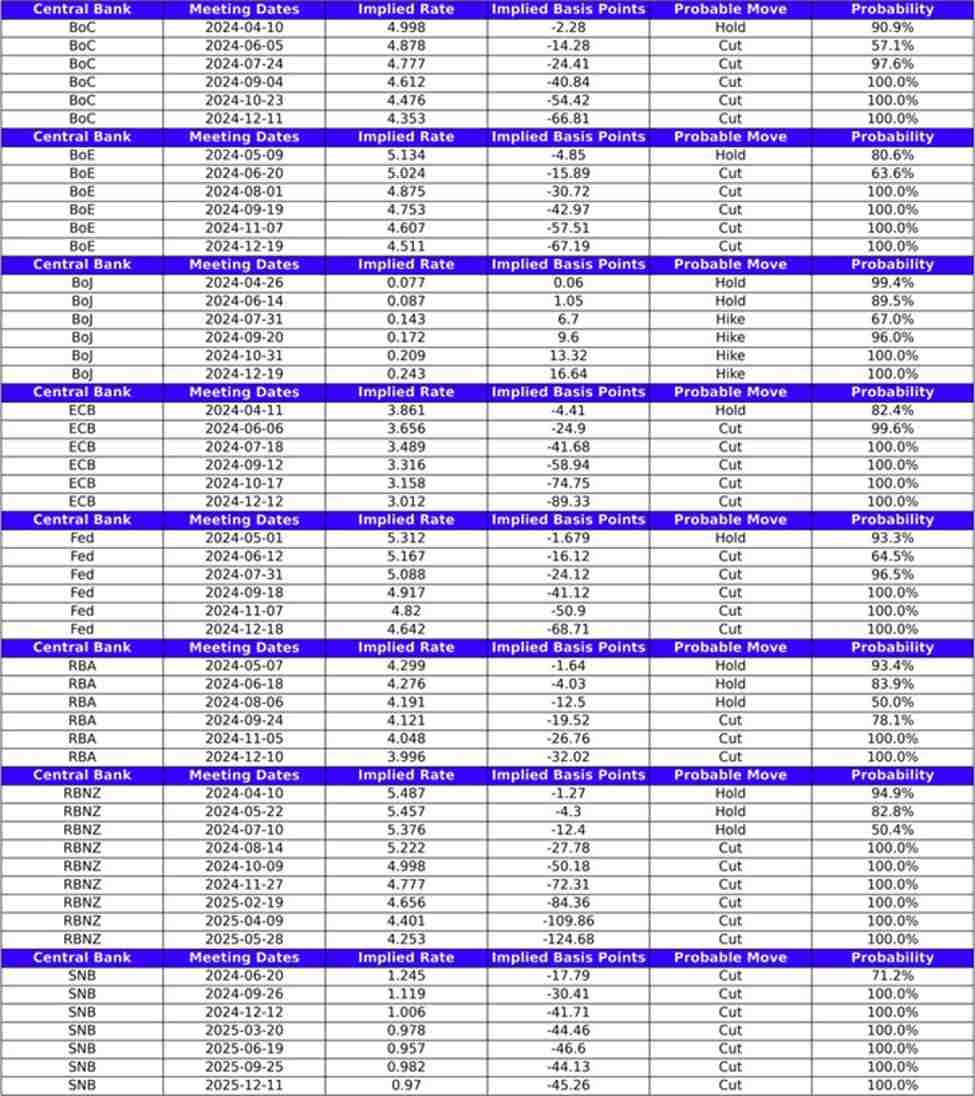

Below is a handy table that shows what type of interest rate changes are expected for the major central banks over their next few policy decisions. Markets have certainly come a long way in pricing out some of the aggressive cuts we saw at the start of the year. There was a lot of chatter on Monday about the first rate cut for the Fed being pushed back to September. I don't think that tells the whole story though. Yes, technically the first cut is fully priced in for September, but there is still 24 basis points of cuts implied for July, which is just a whisker away from 25. Other pricing that I'm keeping an eye on this week is for the SNB. Markets are currently pricing a 71% probability of a cut in June. Which means Thursday's inflation data will be important for how that view evolves.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.