PalmPay Launches USSD Service for Nigerian Consumers

The Rise of Mobile Money in Nigeria

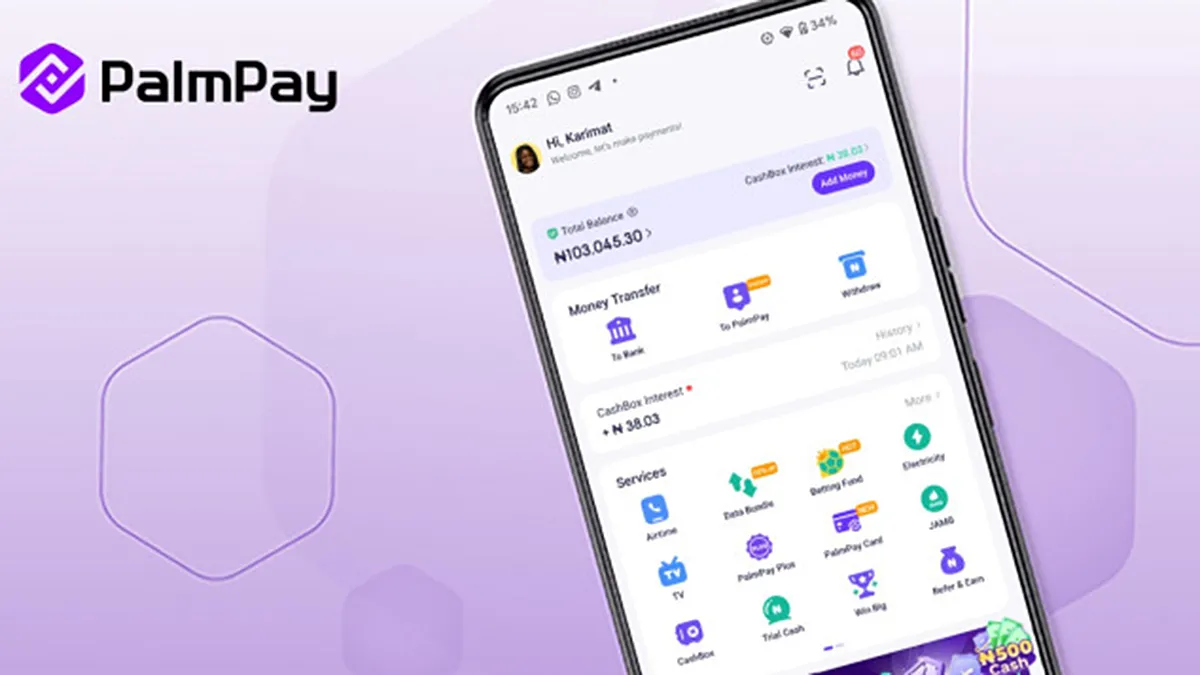

In a bid to improve financial accessibility, PalmPay has launched an innovative Unstructured Supplementary Service Data (USSD) service for Nigerian consumers. This move is a significant leap in the mobile money landscape, fostering greater inclusion.

Why USSD?

The USSD platform simplifies transactions, making banking services available directly from mobile devices without the need for internet connectivity. As more consumers in Nigeria seek reliable financial services, this feature opens new avenues for ease of use and transaction processing.

Support from Central Bank of Nigeria

- The Central Bank of Nigeria endorses the initiative to boost mobile financial services.

- This regulatory backing strengthens trust in fintech solutions.

- The USSD service aligns with national efforts to promote digital literacy and reduce financial exclusion.

Enhanced Accessibility for Consumers

With the introduction of the USSD service, PalmPay aims to provide mobile-money solutions that cater to the growing number of Nigerians seeking quick and effective payment methods. This innovation not only highlights the shift towards digital finance but also underscores the potential for broader market integration.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.