Insights on Eurozone Flash CPI Data and Market Expectations

Insights on Eurozone Flash CPI Data

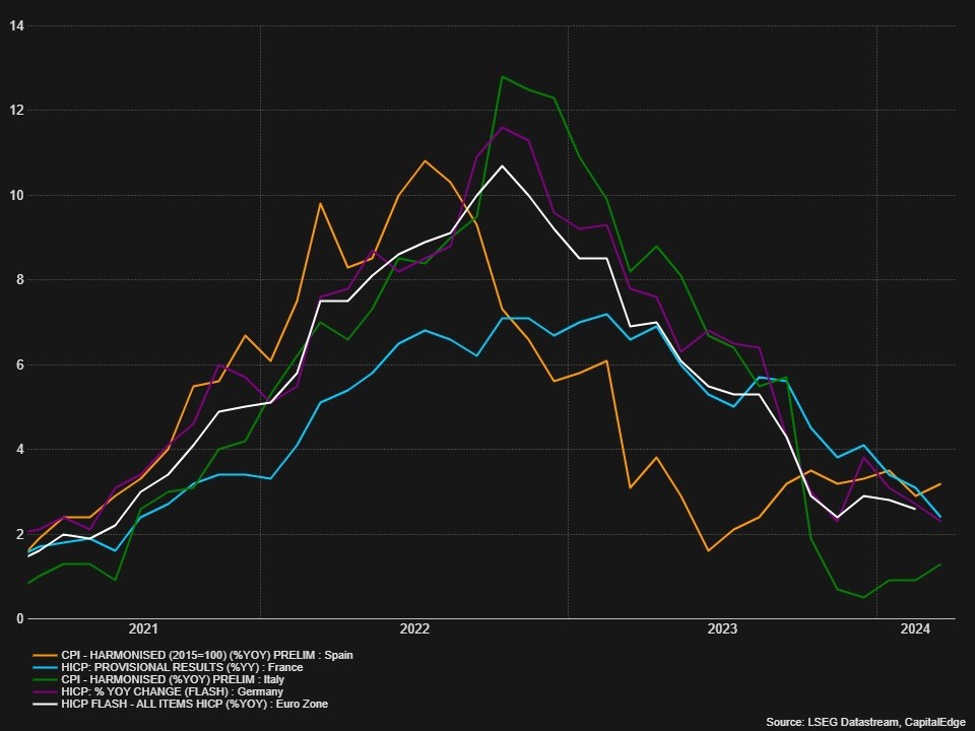

Eurozone flash CPI data release is anticipated to impact market expectations for the upcoming ECB meeting.

- Expected HICP Flash YY: 2.6% (prior 2.6%)

- Expected HICP Core YY: 3.0% (prior 3.1%)

Market Expectations and Forecast Insights

Market analysts are uncertain about the potential surprises today's data may bring, as rate forecasts suggest the need for a significant deviation to alter market expectations. A hold for the next ECB meeting is currently priced at 80%, while a June cut is priced at 99%. This indicates that a substantial change in today's data would be required to shift market sentiment significantly.

If the core YY breaks below 3.0%, it could provide dovish policymakers at the ECB with more leverage in the upcoming deliberations.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.