Global Bonds React to Speculation on Fed's Interest Rate Policies

Tuesday, 2 April 2024, 08:51

Global Bonds Decline Amid Speculation of Delayed Fed Interest Rate Cuts

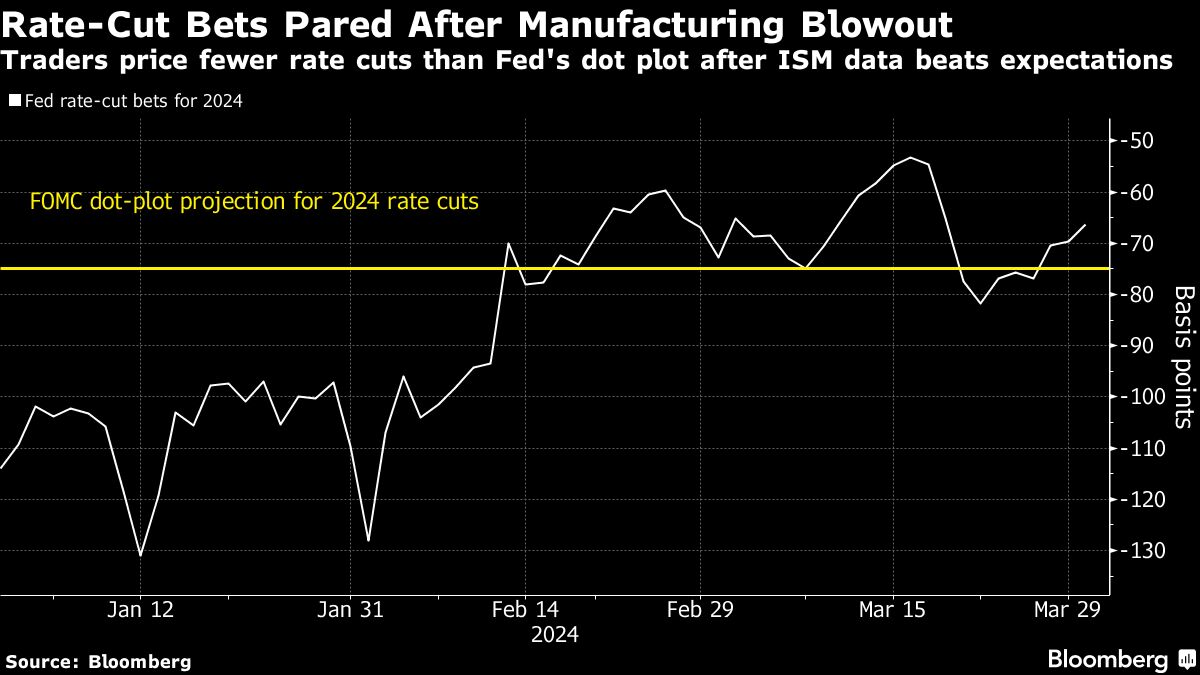

Global bonds dropped in response to the selloff in Treasuries, with traders reconsidering the possibility of fewer interest-rate cuts by the Federal Reserve.

Key Points:

- Market Response: Bonds worldwide experienced a decline in value.

- Fed's Policy Impact: Speculation on the Fed potentially delaying interest rate cuts affected market sentiment.

- Investor Uncertainty: Traders are adjusting their positions amid the uncertainty surrounding future Fed decisions.

The changing expectations regarding the Fed's interest rate policies are influencing market dynamics and investor behavior.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.