USD Strengthens with Surge in Treasury Yields: Analyzing the Market Impact

Monday, 1 April 2024, 21:16

Market Recap:

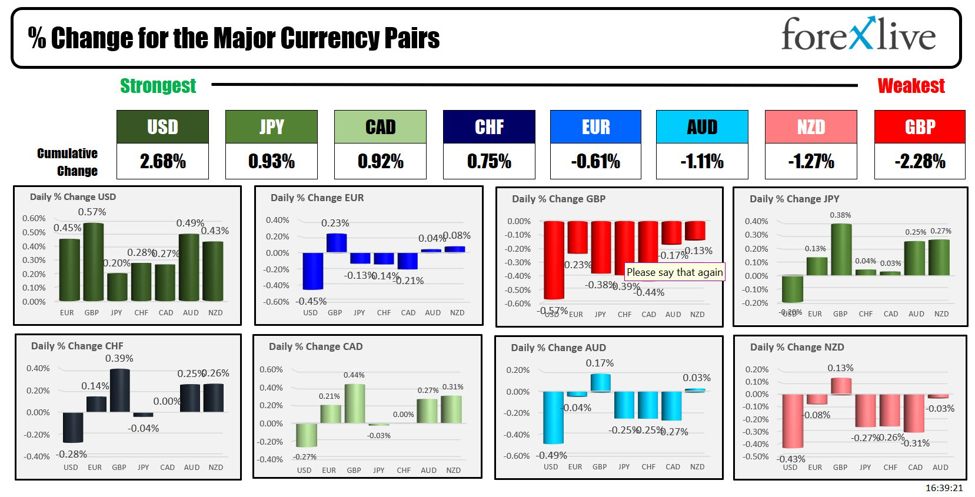

The USD surged as Treasury yields hit new highs, influenced by positive ISM manufacturing data.

Impact on Fed Rate Expectations:

- Fed Watch Update: Chance of an FOMC June rate cut decreases as Treasury yields escalate.

- Atlanta Fed Q1 GDP: Revised to +2.8% amidst evolving economic conditions.

- Changes in USD Strength: Reflects market reactions to yield movements and Fed officials' comments.

This financial update analyzes the role of Treasury yields in driving USD performance and market shifts across various asset classes.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.