Impact of Strong ISM Data on Fed Rate-Cut Odds

Impact of US Manufacturing Data

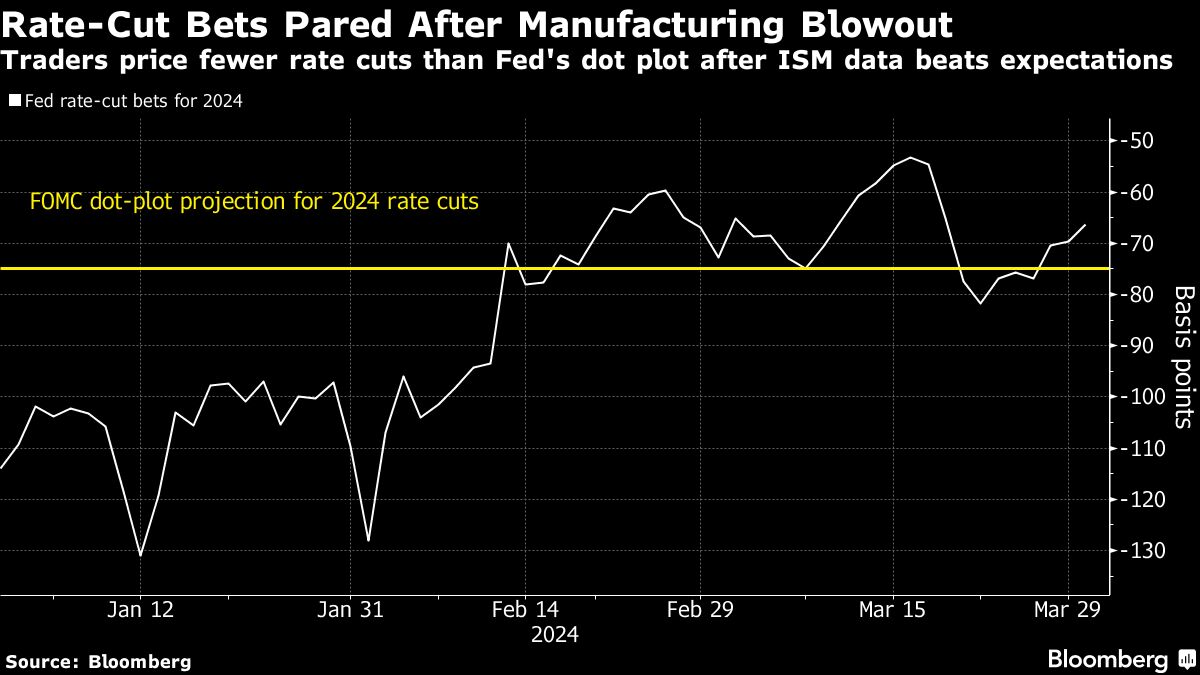

Bond traders adjusted their expectations for Federal Reserve rate cuts following the latest US manufacturing activity report. The odds of a rate cut in June dipped below 50% after the sector showed expansion for the first time since 2022.

Market Sentiment Shift

- Bond Traders: Priced in less monetary-policy easing by the Federal Reserve.

- US Manufacturing: Showed expansion for the first time since 2022.

This change reflects the positive development in the US manufacturing sector and its implications on monetary policy decisions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.