TriplePoint Venture Growth: Analyzing Speculative Bets in the Current Market

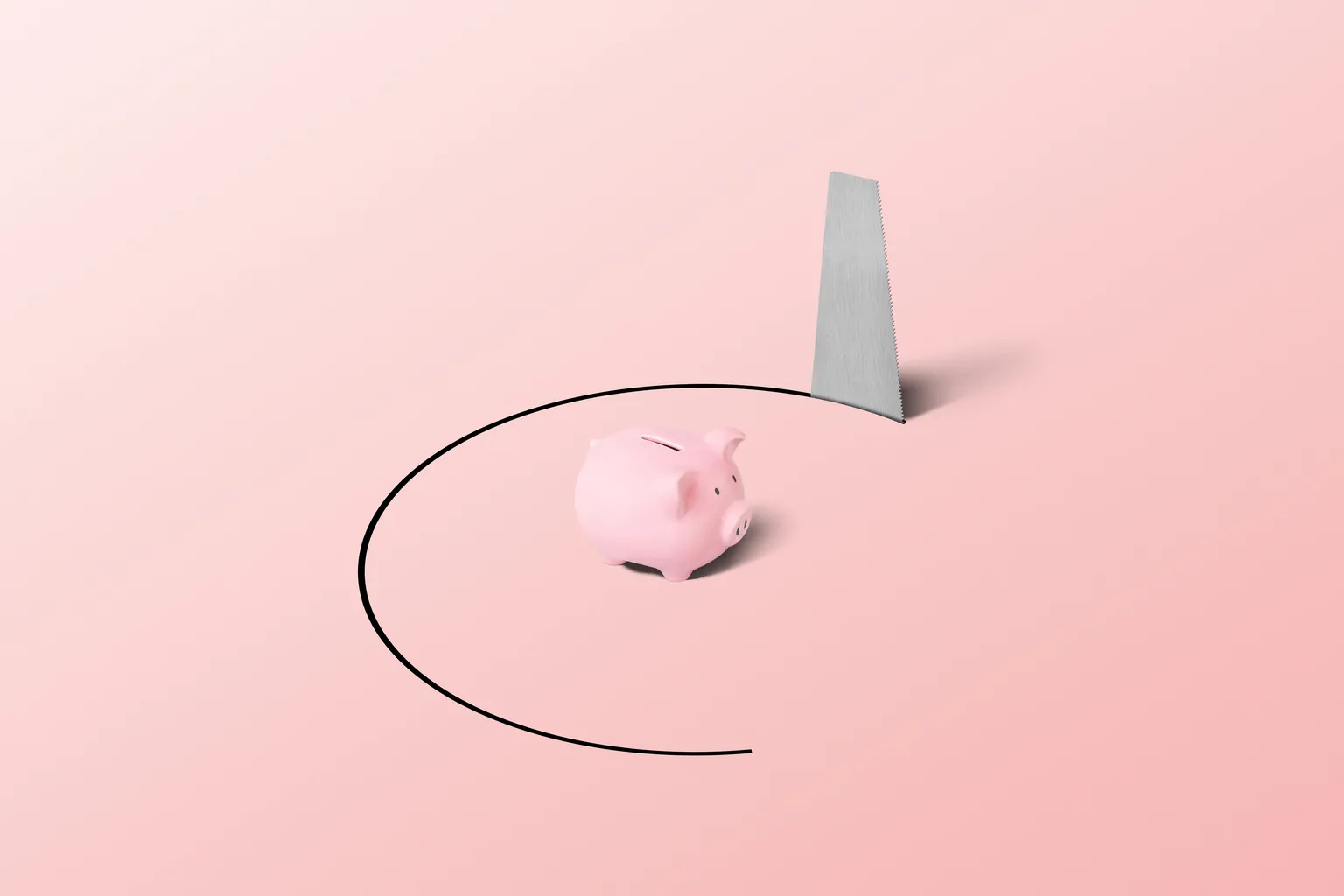

Reasons to Approach TriplePoint Venture with Caution

As investors look towards opportunities in the market, TriplePoint Venture Growth (TPVG) presents a mixed bag. With recent valuation fluctuations, it's important to analyze the current investment climate.

Understanding P/NAV Discounts

The steep Price to Net Asset Value (P/NAV) discount is a key indicator that highlights the challenges TPVG is facing. Investors should assess these financial metrics cautiously.

- Liquidity Concerns: The potential for liquidity issues arises from the current market volatility.

- Market Indicators: Keeping an eye on broader market trends is essential for informed decision-making.

Investment Strategies Moving Forward

Investors are advised to take a step back and reassess their strategies. Adequate research and a deep understanding of the market dynamics are crucial.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.