Texas Pacific Land: Good Prospects Amid Valuation Concerns

Texas Pacific Land's Unique Investment Model

Texas Pacific Land Corporation (TPL) stands out in the financial landscape with its unique business model, focusing primarily on land ownership and resource management. The company's strategy has resulted in high earnings quality and consistent dividends, making it an attractive option for many investors. However, recent analyses suggest that Texas Pacific Land may be overvalued, which poses challenges for value-investing enthusiasts.

Prospects and Challenges

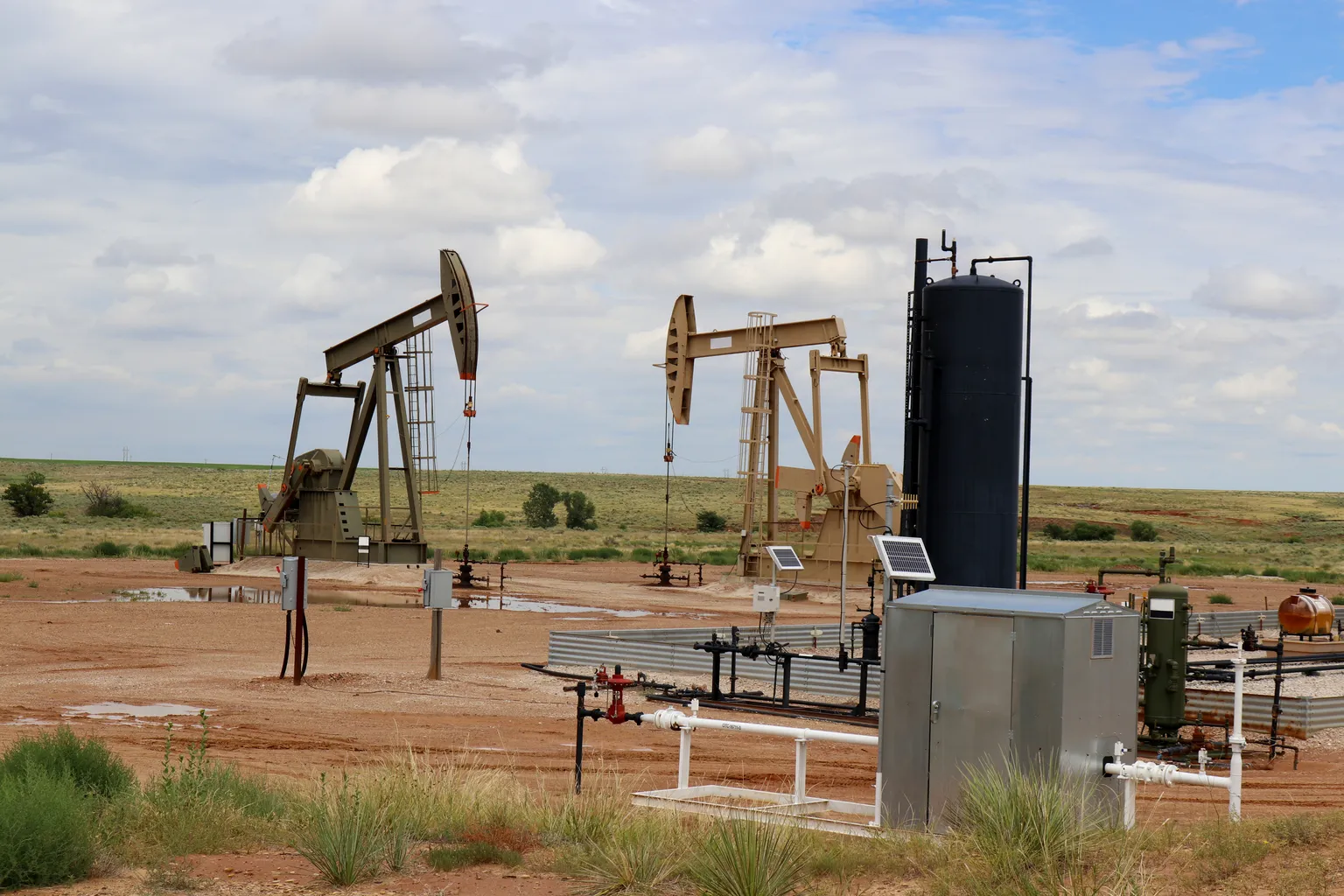

In a market that rewards strong performance, Texas Pacific Land's prospects remain encouraging thanks to its diversified revenue streams, which include royalties from oil and gas production. Nevertheless, the sharp rise in its stock price has led analysts to caution potential investors about inflated valuations compared to fundamentals.

Conclusion: A Balanced View

Therefore, while TPL demonstrates significant profitability and dividend reliability, investors should remain vigilant about its valuation metrics to avoid potential pitfalls.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.