Boeing’s Bonds Surge Amid Stock Dive Over Strike Fears

Boeing's Bond Market Resilience

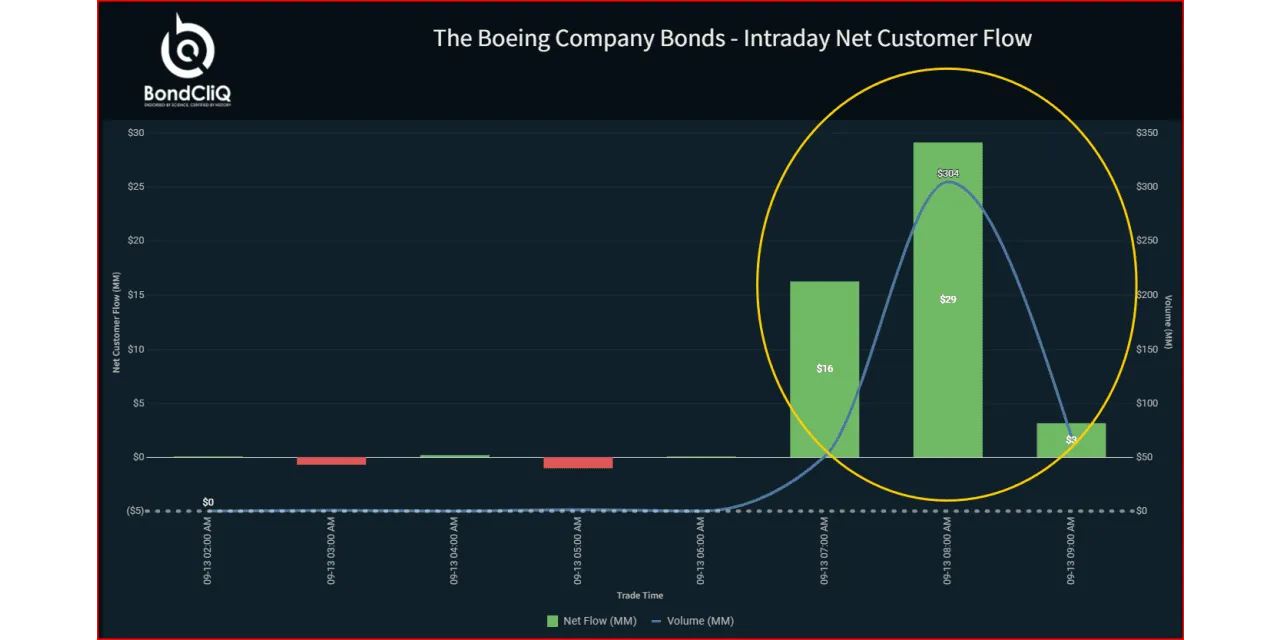

Boeing’s stock has recently faced a downturn on strike worries, yet its bonds tell a different story. As some employees voted for a strike, bond investors remain optimistic, driving demand for the company's outstanding notes.

Market Reactions

Despite share price fluctuations, the bond spreads have remained stable. Investors are seizing the opportunity to capitalize on the strong volume of Boeing's bonds.

- Bondholders exhibit confidence even amidst stock market volatility.

- This trend underscores the importance of bonds as a safe haven.

Decision Factors

Market experts suggest diverse factors influence this bond acquisition:

- Prospects of Boeing’s long-term stability.

- Yield opportunities compared to market volatility.

- The significant demand in fixed-income securities amidst uncertainty.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.