The Most Notable Recession Indicator Stops Flashing Red: Insights on the Yield Curve Dynamics

The Yield Curve Shift: Analyzing Current Trends

For much of the last two years, the 2-year US Treasury yield previously traded above the 10-year yield. This phenomenon, known as an inverted yield curve, historically indicates looming recession risks. However, as of recently, this indicator has flipped, resulting in what is termed an uninverted yield curve. This shift raises significant questions for investors regarding future economic conditions.

Impacts of Recent Economic Data

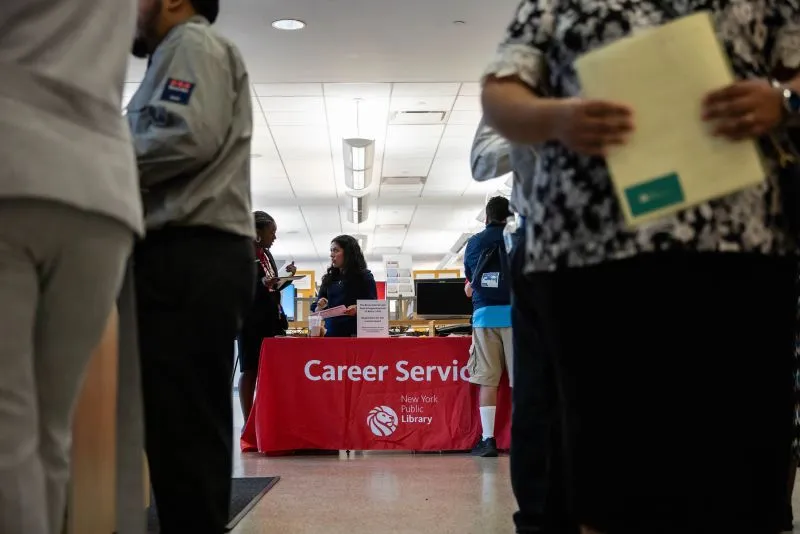

- The unemployment rate edged down slightly in August.

- Employers are hiring fewer workers than in prior years.

- Shorter-duration Treasury yields like the 2-year are moving down.

While the Federal Reserve might initiate interest rate cuts soon, historical patterns suggest that an uninverted yield curve can precede a recession. This observation was as evident in previous economic downturns, where a similar sequence was noted.

Expert Opinions and Alternative Indicators

- Marco Giacoletti emphasizes that the dis-inverted yield curve should not be viewed in isolation.

- Kristina Hooper expresses skepticism regarding imminent recession fears.

- Kevin Flanagan prefers analyzing labor market indicators over yield curves.

Despite an uptick in unemployment rates triggering separate recession predictors, indications from initial jobless claims offer a more stable view that current economic conditions remain relatively healthy compared to past recessions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.