RYLD ETF: High Yielding Small-Cap Solutions Amid Market Challenges

RYLD ETF Overview

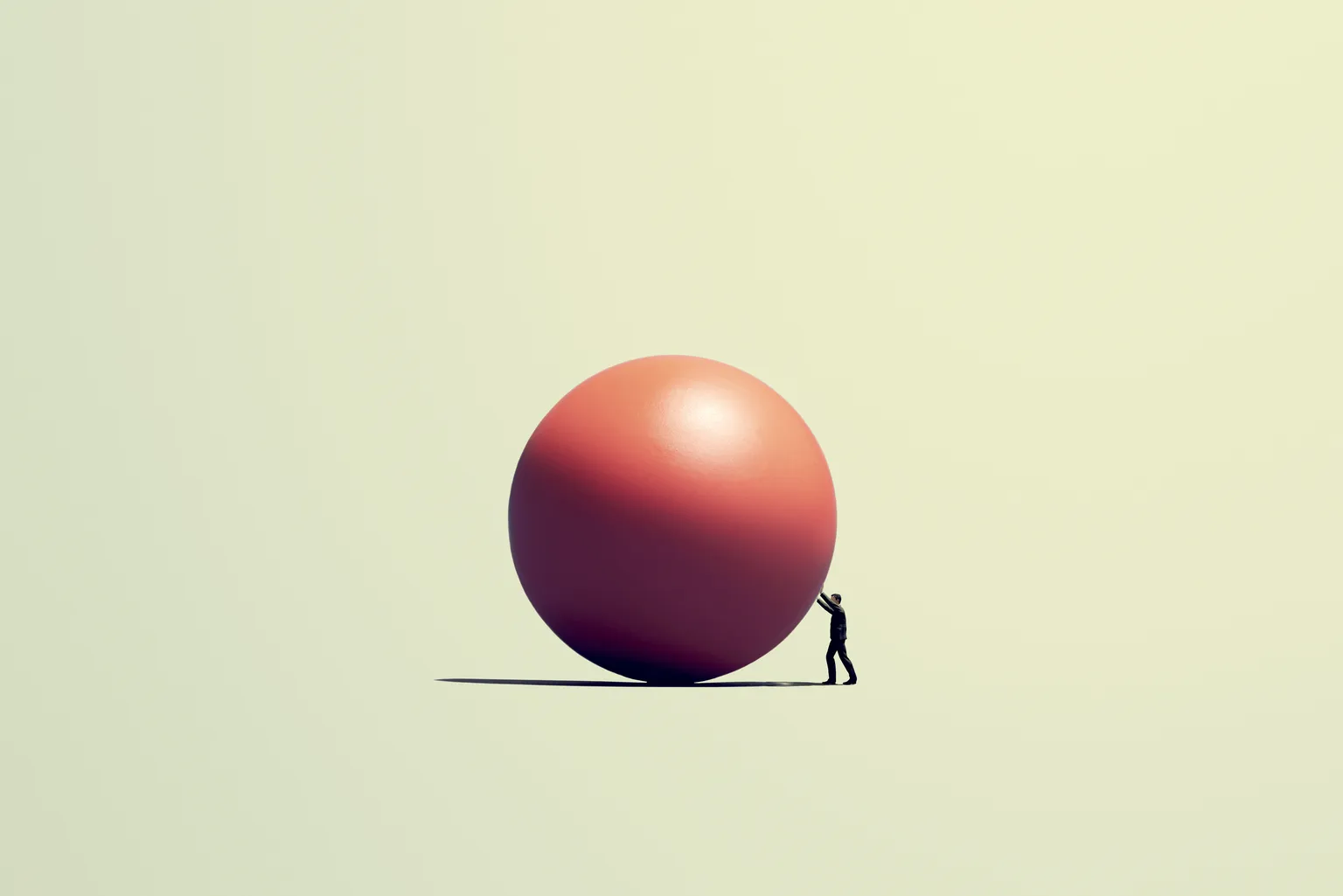

The RYLD ETF stands out for its ability to deliver high yield through strategic investments in small-cap stocks combined with covered call options. This strategy aims to provide downside protection, making it appealing to risk-averse investors.

Performance Considerations

While RYLD can offer substantial yields, investors must be cautious. In strong markets, this particular ETF may face underperformance due to the limitations of its covered call approach.

- High yield potential with small-cap exposure

- Downside protection through covered calls

- Performance hiccups in bullish markets

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.