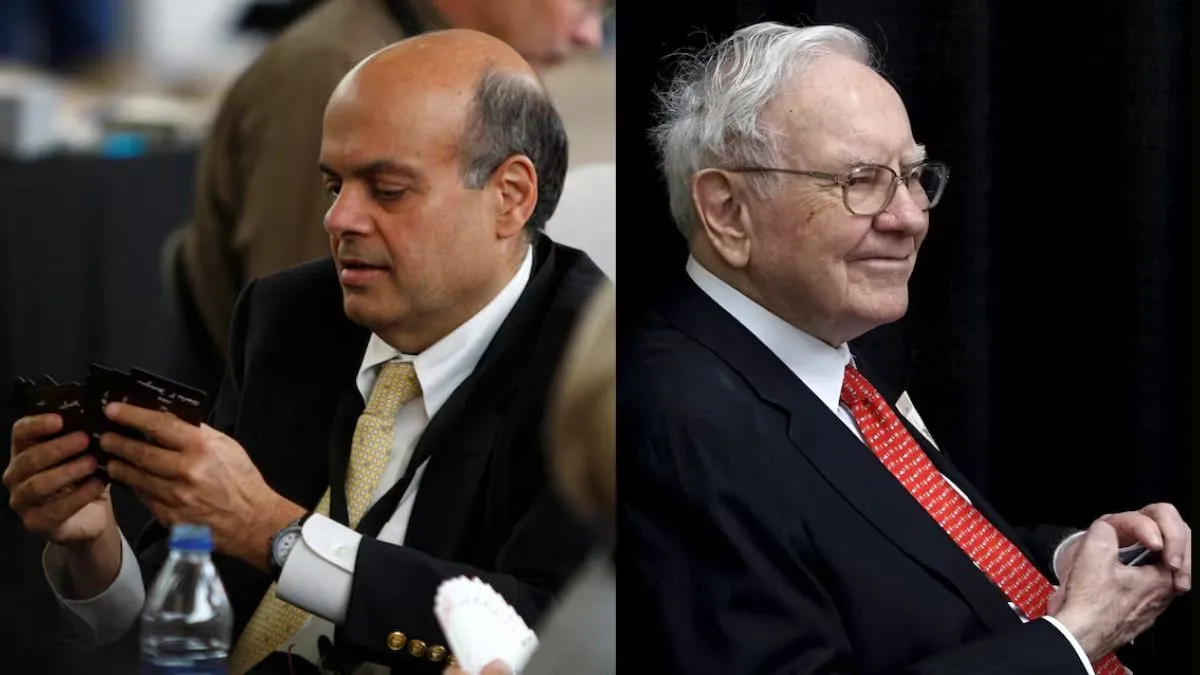

Ajit Jain's Half Stake Sale in Berkshire Hathaway Raises Questions

Understanding the Sale of Berkshire Hathaway Shares by Ajit Jain

Ajit Jain, Vice Chairman of Berkshire Hathaway and a key lieutenant to Warren Buffett, has sold more than half of his stake in the company, according to a regulatory filing dated September 9. The move, which raised $139 million, comes in the wake of Berkshire Hathaway share price surpassing $1 trillion in market capitalization for the first time.

Details of Ajit Jain's Transaction

The Securities and Exchange Commission (SEC) filing reveals that Jain sold 200 of his Class A shares at an average price of $695,418 per share. This divestiture represents approximately 54 percent of Jain’s total holdings in the conglomerate, according to Moneycontrol.

Following the sale, Jain retains only 61 Berkshire shares. Family trusts under his and his wife, Indirma Jain’s names, hold an additional 55 shares, while the non-profit Jain Foundation Inc. possesses 50 shares.

Philanthropic Implications of Jain's Sale

Jain’s philanthropic efforts have significantly impacted his stock holdings as he donated a substantial portion of his stock to the foundation, which focuses on researching dysferlinopathy, affecting his son. The foundation estimates the disorder affects fewer than eight people per million, according to Financial Times.

Reasons Behind the Strategic Sale

While the timing of the sale may appear sudden, there could be strategic reasons behind Jain’s decision. David Kass, a finance professor at the University of Maryland’s Robert H. Smith School of Business, was quoted by CNBC International as saying, “This appears to be a signal that Ajit views Berkshire as being fully valued.” In other words, he might think the value of Berkshire Hathaway shares has peaked, and there may not be a better time to cash in than now.

Buffett's own assessments may align with this sentiment, as he indicated during his annual letter to shareholders that future returns could be more tempered.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.