Assessing the Implications of Dallas Fed's February Trimmed Mean PCE Price Index

Friday, 29 March 2024, 16:43

Assessing the Dallas Fed's February Trimmed Mean PCE Price Index

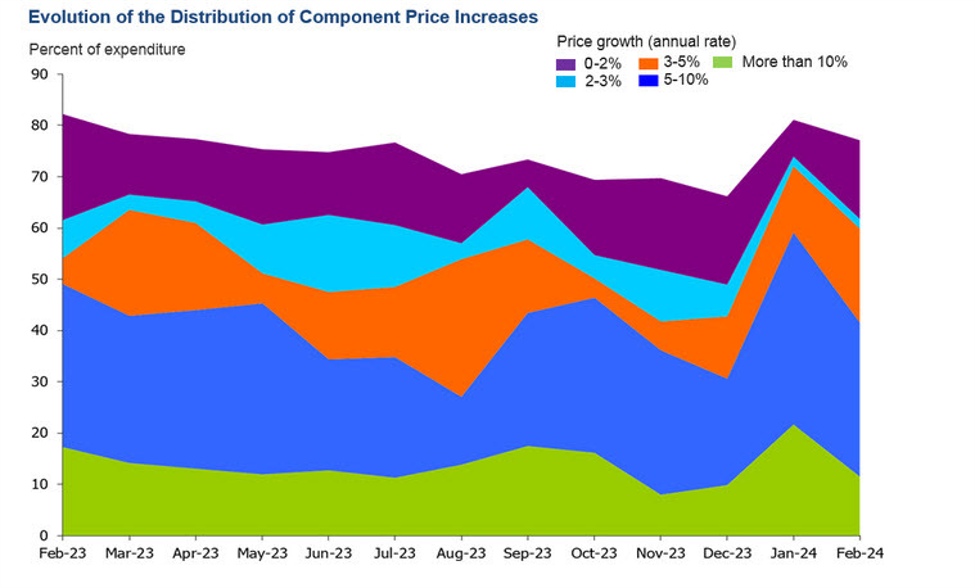

The Dallas Fed's recent release of the February trimmed mean PCE price index showed a decline to 3.4% from the previous 5.7%. This raises important questions about the trajectory of core inflation and its implications for the economy.

Key Findings:

- Momentum Shifts: One-month annualized index decreased to 3.4% from 5.7% prior

- Notable Changes: Rising costs in health care services, utilities, and vehicle maintenance

- Market Impact: Health care costs are increasing at a significant rate, reflecting broader inflationary pressures

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.