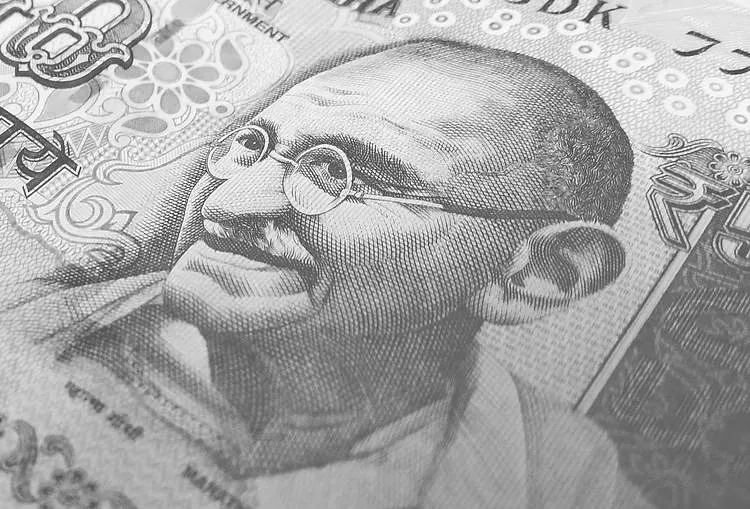

USDINR Analysis: Indian Rupee Gains Ground with a Tepid US Dollar

USDINR Trends

The USDINR pair demonstrates a notable shift as the Indian Rupee appreciates while the US Dollar remains in a tepid state. Analysts are paying close attention to macroeconomic factors impacting both currencies, particularly upcoming data releases.

Macroeconomic Influences

With the Michigan Consumer Sentiment data on the horizon, market participants will gauge consumer outlooks affecting economic sentiment. The Indian Rupee's upward trajectory highlights a resilient economy compared to its US counterpart.

Market Levels to Watch

- The US Dollar may retest its six-week low around 83.72.

- Psychological resistance lies at 83.50.

- The nine-day Exponential Moving Average (EMA) currently stands at 83.91, acting as a critical resistance level.

Conclusion: The Future of USDINR

As the currency landscape shifts in Asia, market participants must remain vigilant about factors influencing USDINR pricing dynamics.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.