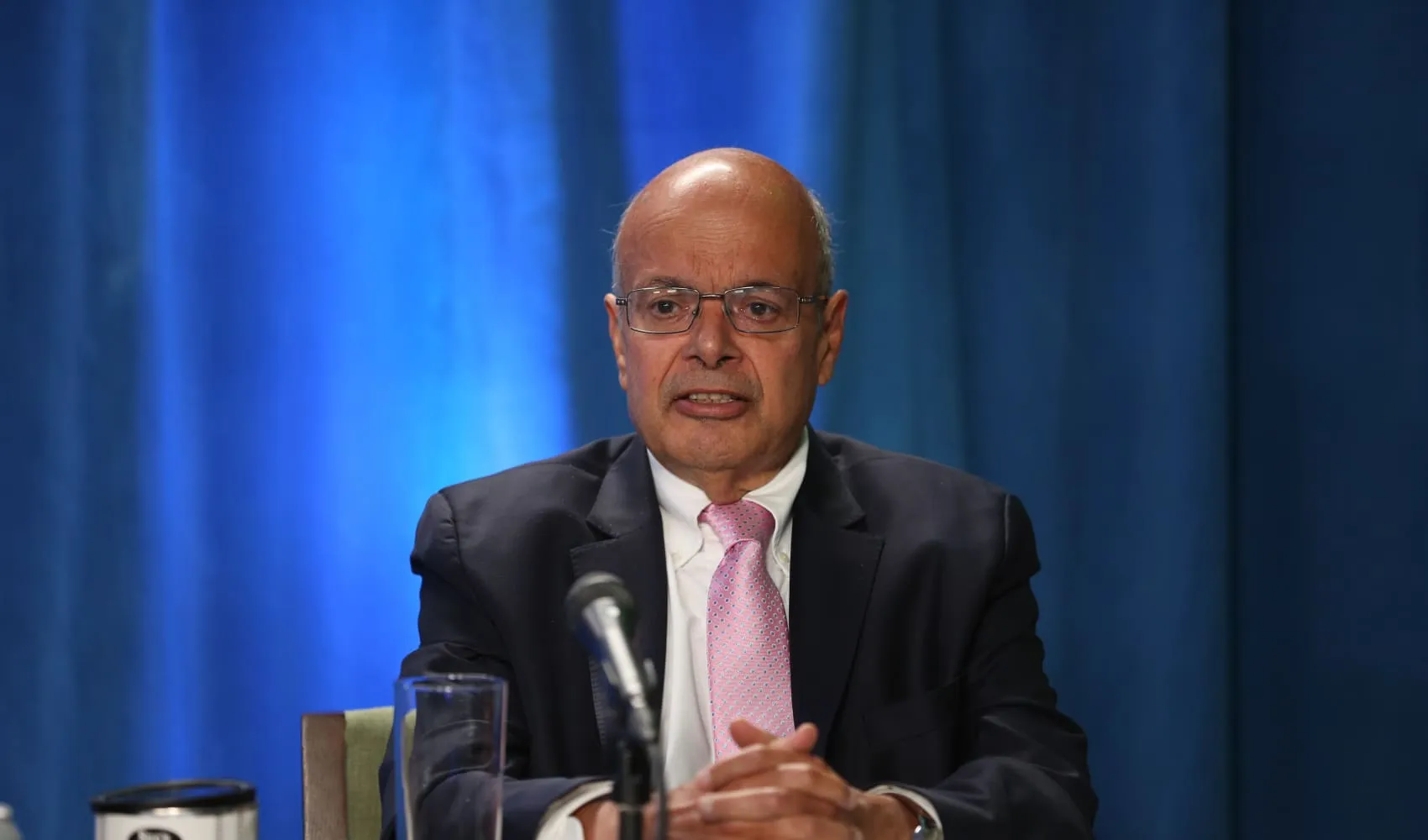

News on Ajit Jain's Substantial Berkshire Stake Sell-Off

Ajit Jain, the 73-year-old vice chairman of insurance operations at Berkshire Hathaway, recently made headlines with a *dramatic sell-off* of more than half of his stake in the company. On Monday, Jain sold 200 Berkshire Class A shares, which amounted to roughly $139 million. This unexpected move has left investors speculating about the future direction of Berkshire's insurance division and potential implications for the broader market.

Investor Sentiment Deteriorating

The news has triggered concerns among stakeholders, signaling possible shifts in investment strategies within Berkshire's leadership. As one of the key figures in Buffett's empire for nearly 40 years, Jain's actions carry significant weight in the financial community.

Market Impact

The implications of Jain’s sell-off extend beyond individual stakeholders, affecting market forecasts and shaping the perceptions around Berkshire's long-term investments. How this decision resonates in financial markets remains to be seen as analysts continue to assess its impact.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.