Immuneering Stock Surges 45% After Promising Pancreatic Cancer Trial Results

Immuneering Stock Surges on Positive Data

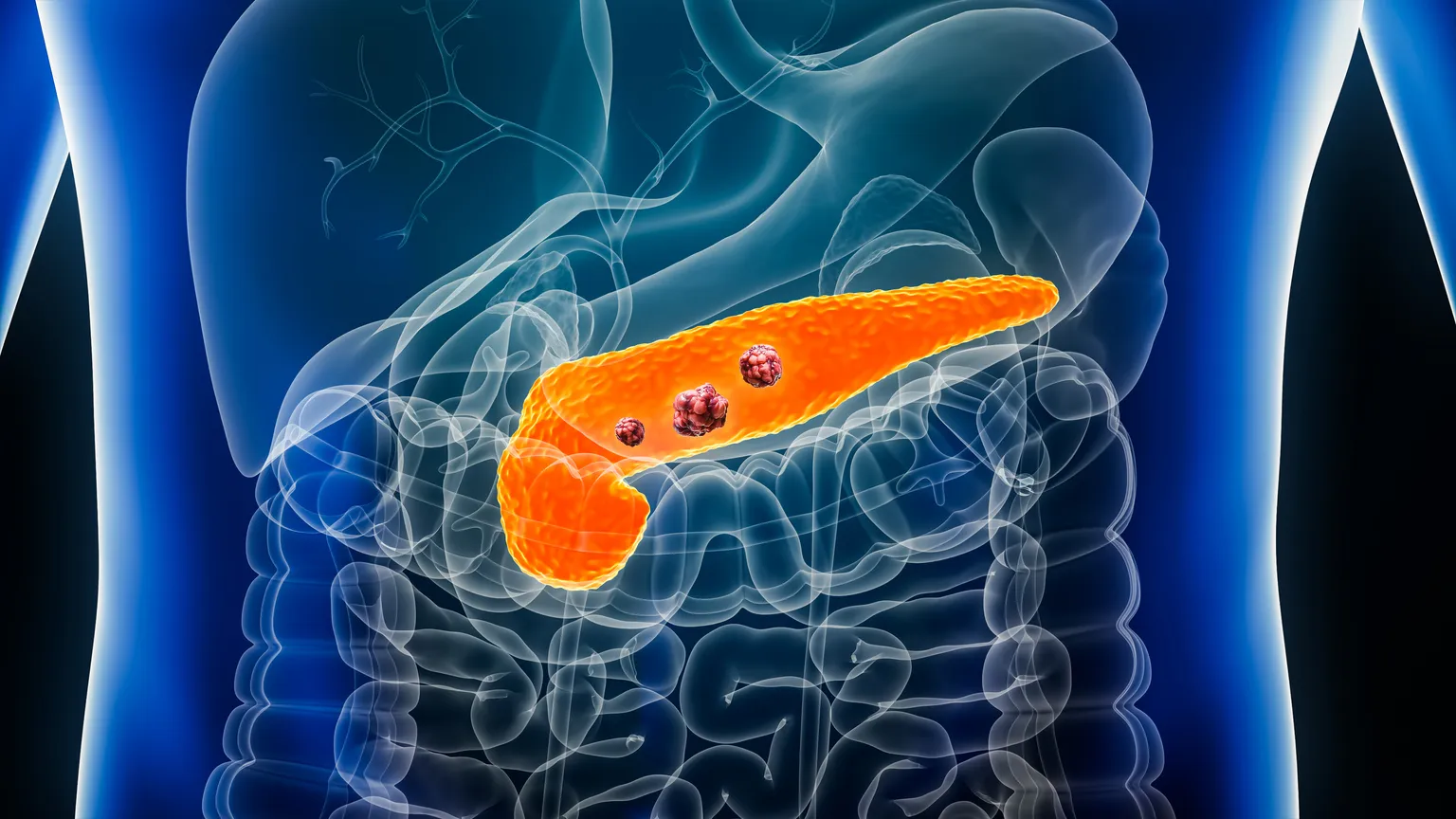

Immuneering (IMRX) stock rocketed 45% in after-hours trading Thursday after the company announced promising results from its Phase 2a trial for IMM-1-104, aimed at treating pancreatic cancer.

Phase 2a Trial Success

The results from the trial demonstrated significant efficacy, garnering attention from investors eager for breakthroughs in oncology treatments. The high response rates in patients indicate the drug's potential to play a vital role in cancer therapeutics.

- Investor Sentiment: The bullish reaction showcases strong investor sentiment grounded in the positive outcomes of clinical trials.

- Market Watch: Continued interest from analysts and experts reflects Immuneering's prospects in a competitive market.

Future Outlook for Immuneering

As the company looks ahead to further stages of research and potential FDA submission, many stakeholders are optimistic about the long-term impacts of IMM-1-104. This surge in stock price not only reflects confidence in current developments but also the anticipated future growth as new treatments enter the market.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.