Conagra Brands (CAG) Anticipates Decrease in Sales and Profit for Q3 2024

Thursday, 28 March 2024, 19:52

Conagra Brands Faces Inflation and Macro Uncertainties

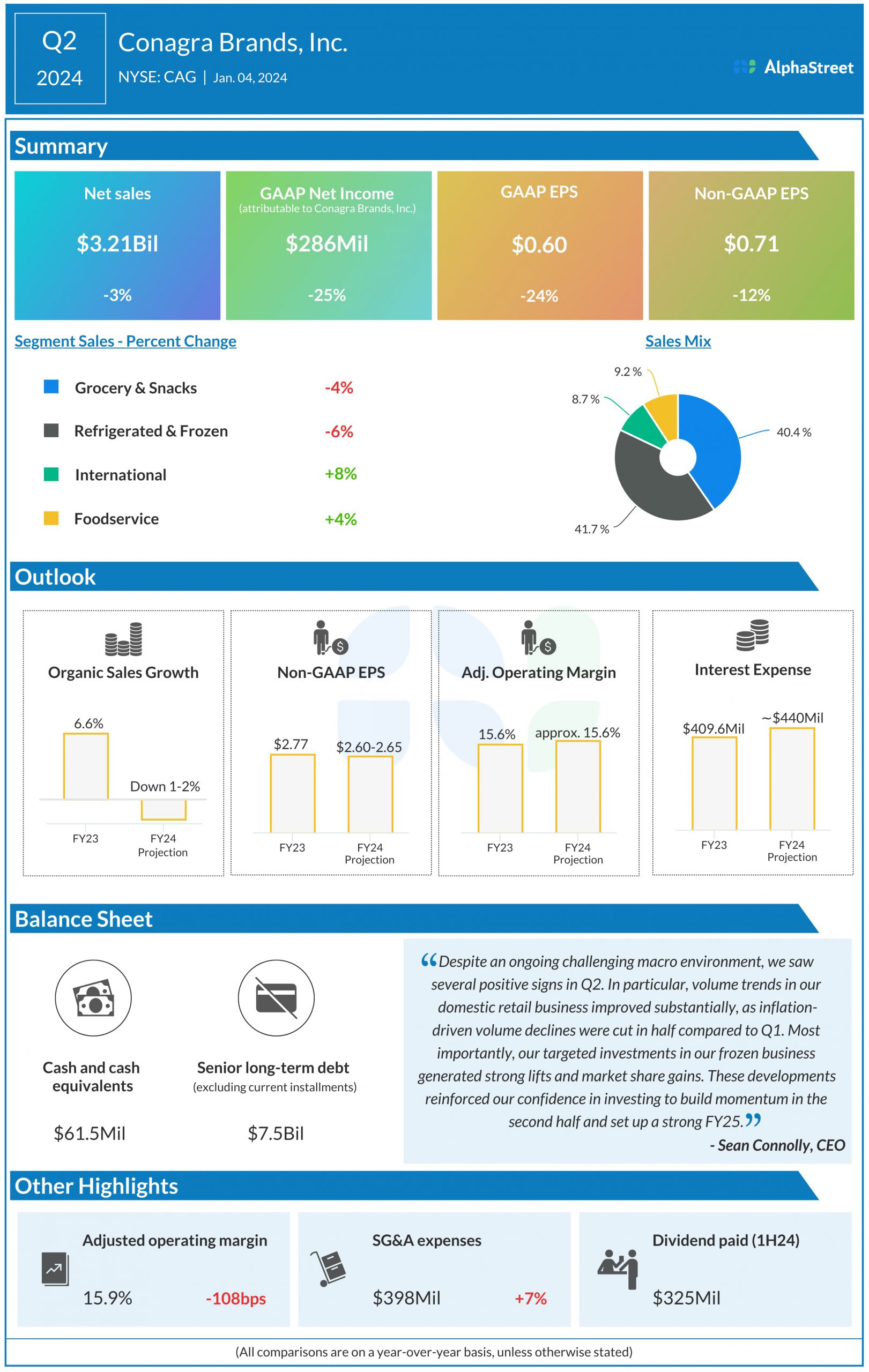

Consumer staples companies, like Conagra Brands, Inc. (NYSE: CAG), are grappling with challenges stemming from inflation and market uncertainties.

Investing in CAG

Conagra Brands is fostering growth through strategic investments despite wary near-term outlook.

Key Points:

- Stock Performance: Showed stability after previous dip

- Consumer Demand: Concerns over stagnant growth in specific categories

- Pricing Strategy: Balancing costs and customer affordability

While short-term sales might dip, the company's brand equity and long-term growth potential are strong.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.