After the Fed Cuts Rates, Mid-Cap Stocks Poised for Big Gains

Mid-Cap Stocks and Fed Rate Cuts

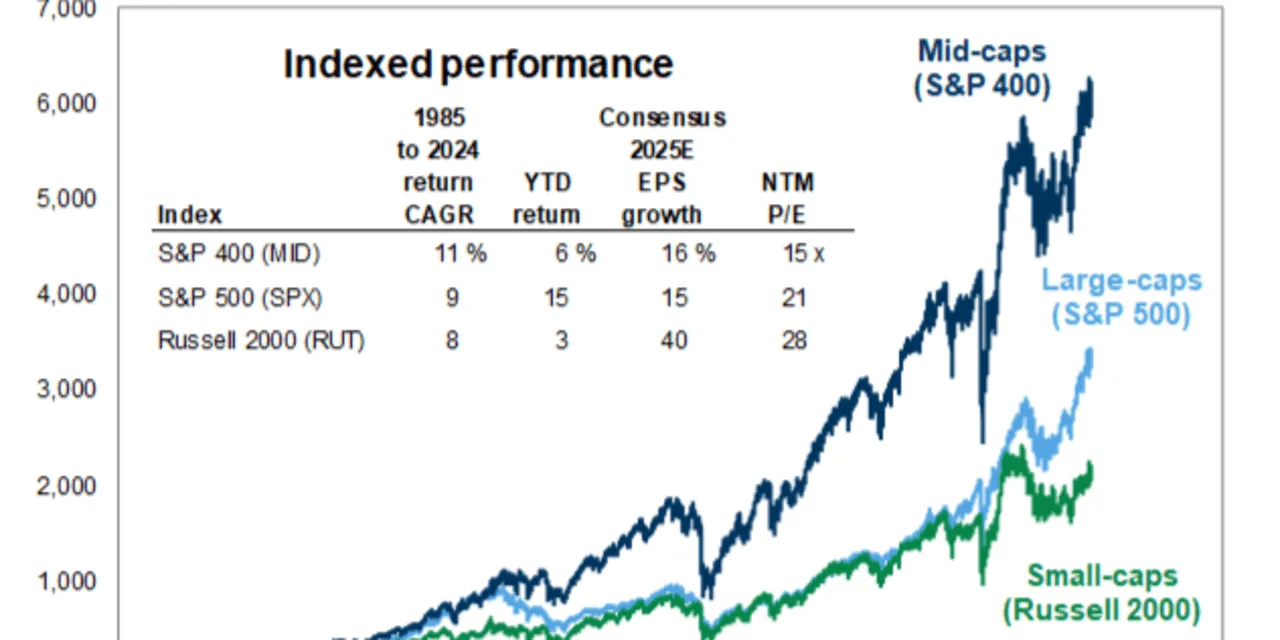

After the Fed cuts interest rates, an often-overlooked corner of the stock market, mid-cap stocks, is poised for big gains. Analysts from Goldman Sachs predict that mid-cap equities will outshine both large-cap and small-cap stocks.

Historical Performance Insights

According to the Goldman Sachs team, mid-cap stocks have typically outperformed large and small counterparts during the year following the first Fed rate cut in an easing cycle. This pattern suggests that following policy adjustments, investors may find substantial opportunities in this sector.

- Mid-cap stocks are characterized by their unique position in the market, often benefiting from increased liquidity and growth potential.

- As senior Fed officials hint at lowering rates next week, market conditions could become highly favorable for mid-cap investments.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.