Congressional Trading: A Critical Look at Microsoft (MSFT) Stock Transactions

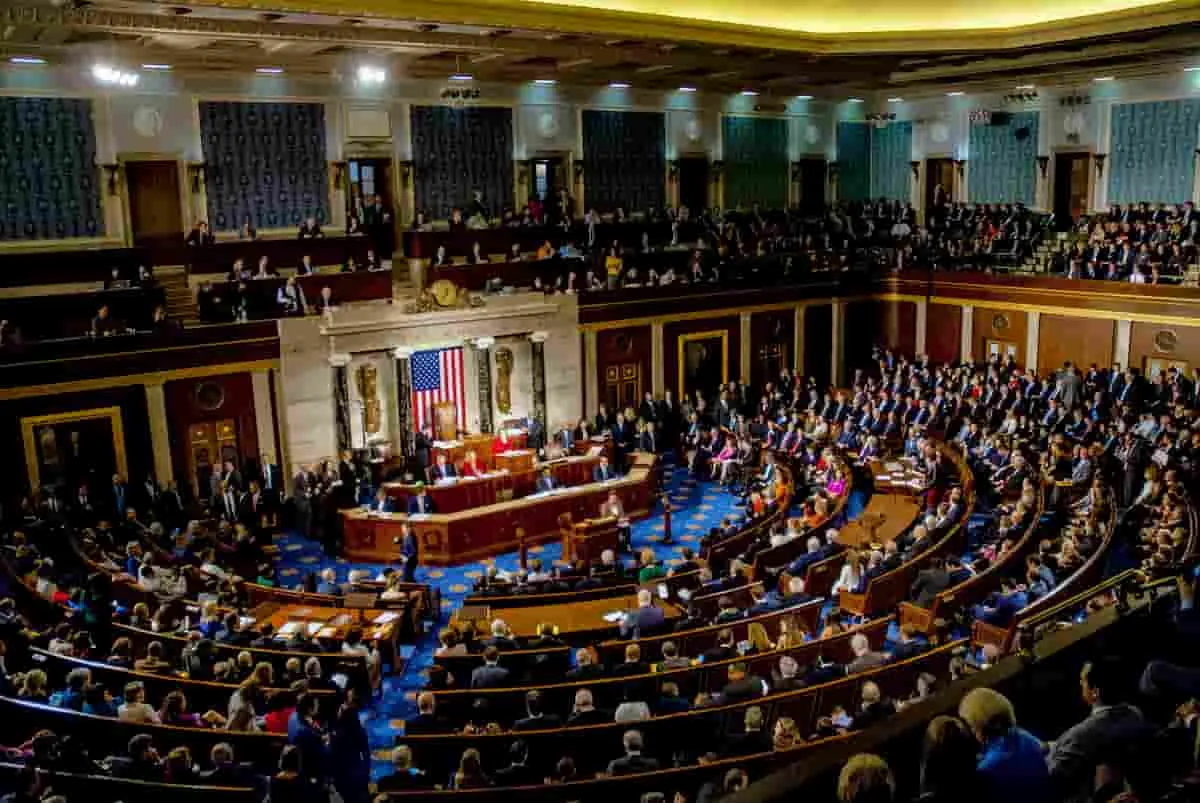

Congressional Trading Under Fire

Congressional trading has become a hot topic with the rise of suspicious trades. Recent reports highlight that New Jersey Congressman Josh Gottheimer executed an eye-catching stock transaction involving Microsoft (NASDAQ: MSFT). This continues a trend where legislators seem to outperform average investors by capitalizing on their unique access to market-moving information.

Key Highlights of Gottheimer's Trading Activity

- In 2024 alone, Gottheimer traded approximately $67 million worth of stocks.

- His significant investments have garnered a mix of praise and criticism.

- In December, he disclosed a substantial investment in Microsoft worth at least $6 million.

Microsoft (MSFT) Stock Dynamics

At present, MSFT shares are trading at $441.02, with year-to-date returns around 18.91%. Gottheimer's trading strategy involves a mix of selling and purchasing call options, potentially exploiting fluctuations in Microsoft stock price. This dual strategy could yield significant gains or losses based on market behavior over the coming years.

Broader Implications of Congressional Trading

- Calls for enhanced transparency in congressional trading activities.

- Potential legislative changes to address perceived conflicts of interest.

- Growing scrutiny of lawmakers' financial activities.

What does this mean for investors? The ongoing discourse around congressional trading raises questions about the equity of financial markets. As lawmakers like Gottheimer leverage their positions, it emphasizes the need for systemic reforms to protect retail investors.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.