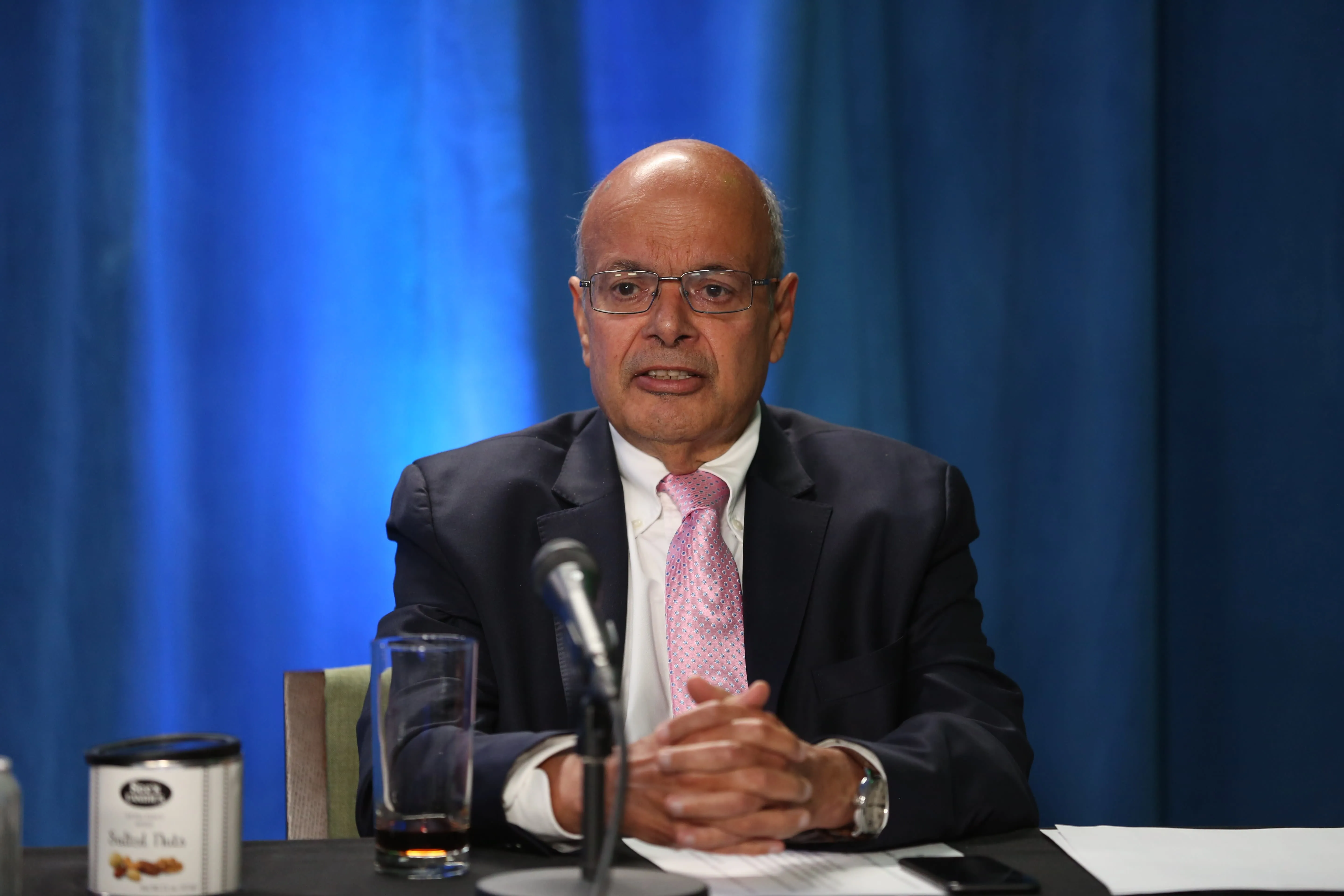

Ajit Jain's Strategic Move in Berkshire Hathaway Inc. Shakes the Investment Strategy Landscape

In a major development within the financial sector, Ajit Jain, the esteemed vice chairman of insurance operations at Berkshire Hathaway Inc., has executed a striking stock market move. Selling over half of his holdings, Jain disposed of 200 Class A shares, amounting to an impressive $139 million. This action not only influences Berkshire Hathaway's positioning in the market but also raises eyebrows among investors keen to understand the potential ramifications on Wall Street and the broader investment strategy landscape.

Key Implications of the Sale

This decision has stirred discussions in financial news circles, with market analysts debating how Jain's actions reflect confidence—or a lack thereof—in the ongoing performance of Berkshire Hathaway Inc.. Investors are urged to pay attention to how this sale might signal future trends in investment strategies.

Market Reactions

- Analysts believe this could indicate a shift in investment strategy.

- Wall Street appears to be maintaining a cautious outlook as a result of this news.

- Other stakeholders may reconsider their positions, following Jain's lead.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.