Kevin O'Leary’s Perspective on Venture Investing in Cryptocurrency

Venture Investing and Cryptocurrency Trends

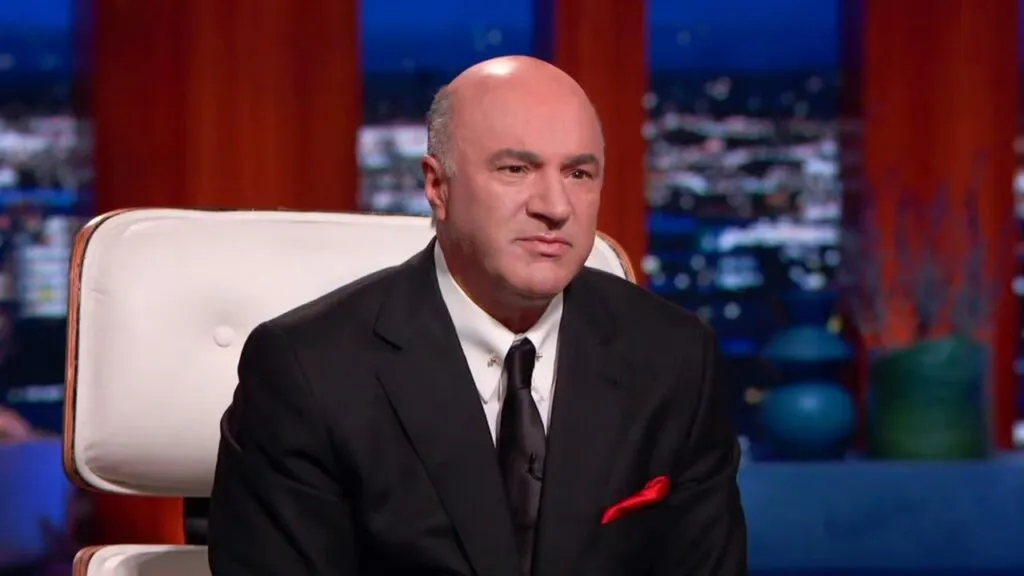

Kevin O'Leary, famously known as Mr. Wonderful from Shark Tank, shares his views on the unpredictable nature of venture investing, particularly in the cryptocurrency arena. In a revealing conversation with Chris Wallace, O'Leary discusses how seemingly random bets, including unconventional ones like cat DNA tests, can lead to significant returns.

Why Randomness Matters

The randomness of investment opportunities can hold the key to covering losses across various markets. O'Leary emphasizes that understanding market dynamics and taking calculated risks are often essential to success.

- Exploration of investment randomness

- Market analysis techniques

- Importance of adaptability

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.