FTX and 3AC: Mark Cuban's Insights on Gensler's SEC Policies

FTX and 3AC: Potential Survival Under Different Regulations

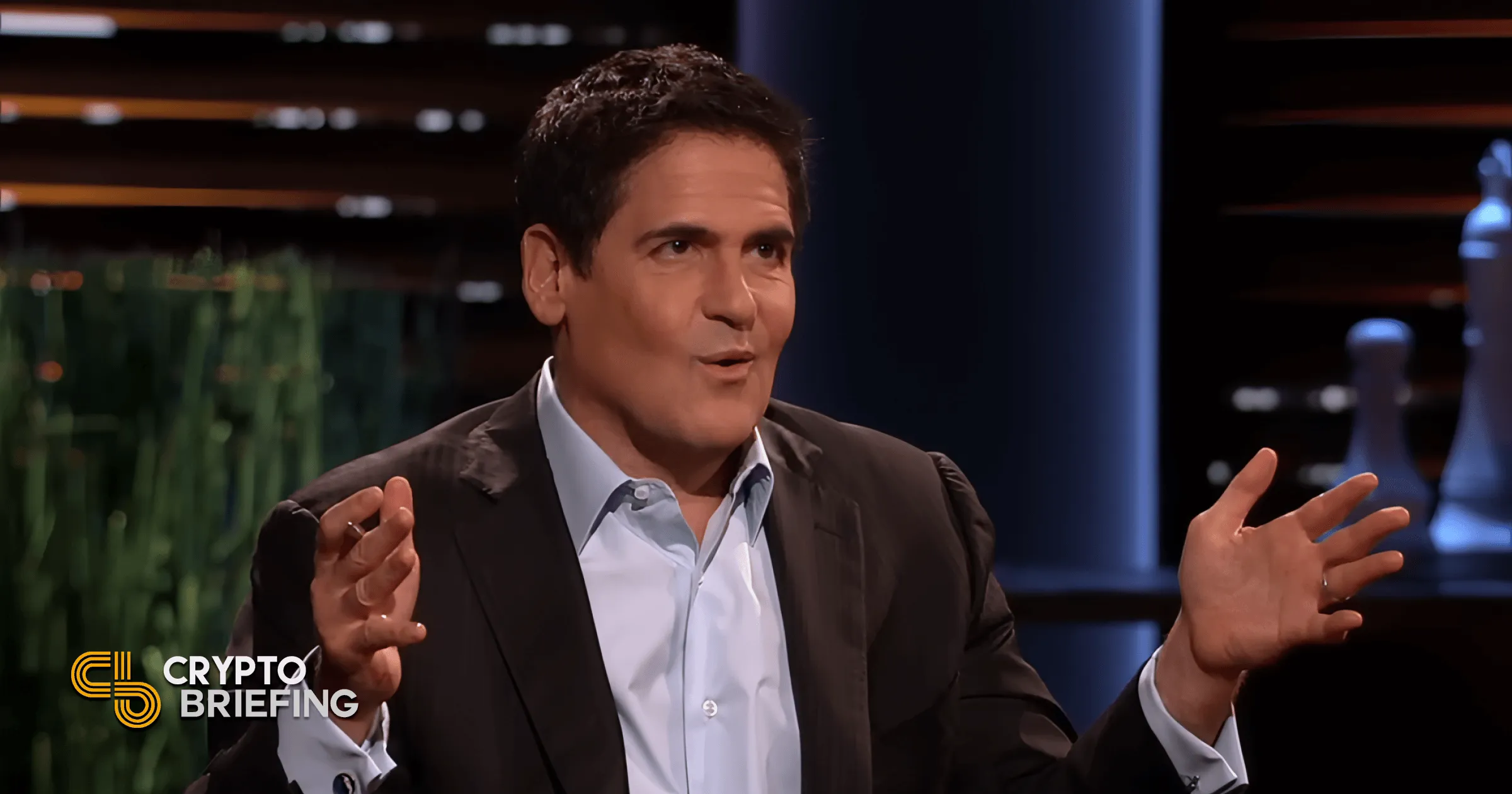

Mark Cuban recently discussed the fates of FTX and Three Arrows Capital (3AC), asserting that these firms might still be operational if SEC Chair Gary Gensler had adopted a more favorable regulatory stance. The entrepreneur believes that Gensler's approach has had severe repercussions for the cryptocurrency landscape.

Understanding Cuban's Perspective

Cuban emphasizes that better communication and regulatory clarity could foster a healthier environment for cryptocurrencies such as Bitcoin and Ethereum. He argues that many investors faced challenges due to ambiguous guidelines.

- Regulatory Framework: Clear regulations can help prevent future collapses.

- Investor Confidence: Streamlined policies may restore trust in crypto markets.

- Innovation: A supportive environment could lead to further advancements in Blockchain Technology.

Future of Cryptocurrency Regulations

As the industry evolves, reflecting on past scenarios like those of FTX and 3AC can guide future regulatory practices. Cuban's insights may serve as a catalyst for discussions on improving the regulatory landscape.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.