Bitcoin Options: Analyzing the $100K Bullish Bet on Deribit Markets

Tuesday, 1 October 2024, 10:42

Bitcoin Options Overview

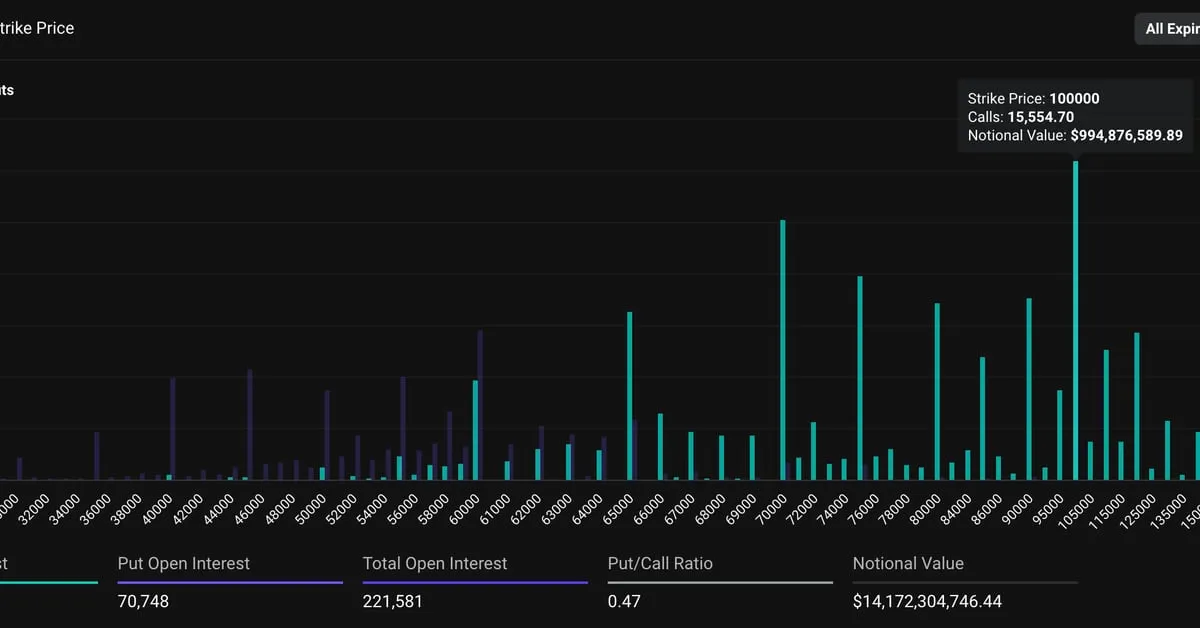

In recent weeks, bitcoin options have taken the trading world by storm, particularly the $100,000 call option on Deribit. This option has gathered almost $1 billion in open interest, signaling a robust bullish sentiment among traders.

Market Dynamics Impacting Bitcoin

- Growing Open Interest: The substantial open interest showcases heightened investor activity.

- Traders’ Confidence: The $100K bet indicates strong belief in a bullish market.

- Deribit Dominance: As a leading platform for bitcoin options, Deribit plays a crucial role in market liquidity.

Implications for Traders

- Market Forecasting: Increased open interest can lead to more predictable market movements.

- Strategic Investments: Investors may look to capitalize on the current bullish momentum.

- Risk Management: Understanding options can help manage exposure in volatile markets.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.