Exploring Bitcoin's Unique Properties Amid BlackRock's IBIT Options Approval

Bitcoin's Resurgence Following BlackRock's Announcement

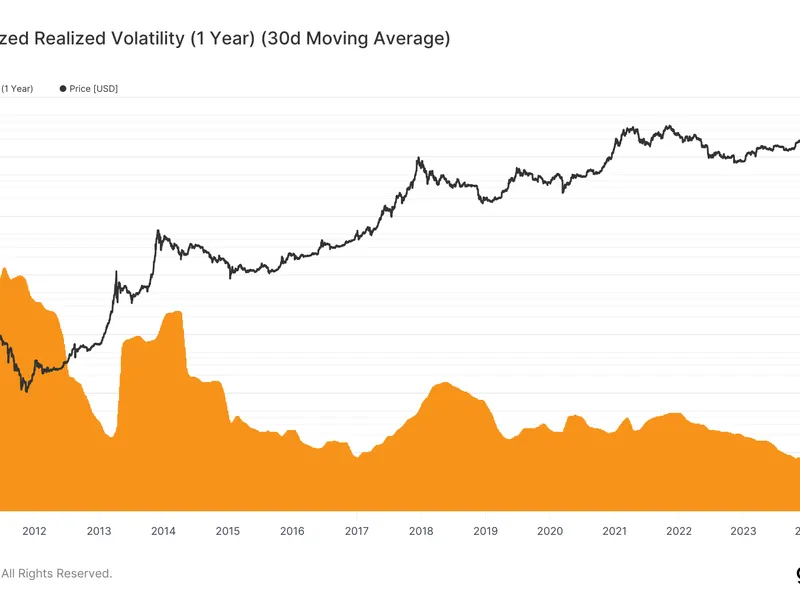

Bitcoin is up 22% since the Yen carry trade unwind on August 5. This significant increase comes as traditional assets like gold and the S&P 500 have only risen around 11%. With over 65% of the circulating Bitcoin now in strong hands, market dynamics are shifting.

BlackRock’s IBIT Options: A Game Changer for Bitcoin

The approval of BlackRock’s IBIT options is crucial for further legitimizing Bitcoin in the eyes of institutional investors. IBIT options could encourage more risk-off strategies, ultimately solidifying Bitcoin as a robust alternative.

- Bitcoin showcases resilience against market fluctuations.

- Growing institutional interest highlights investment opportunities.

- BlackRock’s strategy emphasizes confidence in cryptocurrency.

- Analyze market trends and performance.

- Stay informed on regulatory updates.

- Consider trading strategies to leverage Bitcoin’s potential.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.