Gensler’s Exchange Rule Proposal and Its Impact on DeFi and Crypto Platforms

Gensler’s Exchange Rule Proposal: Overview

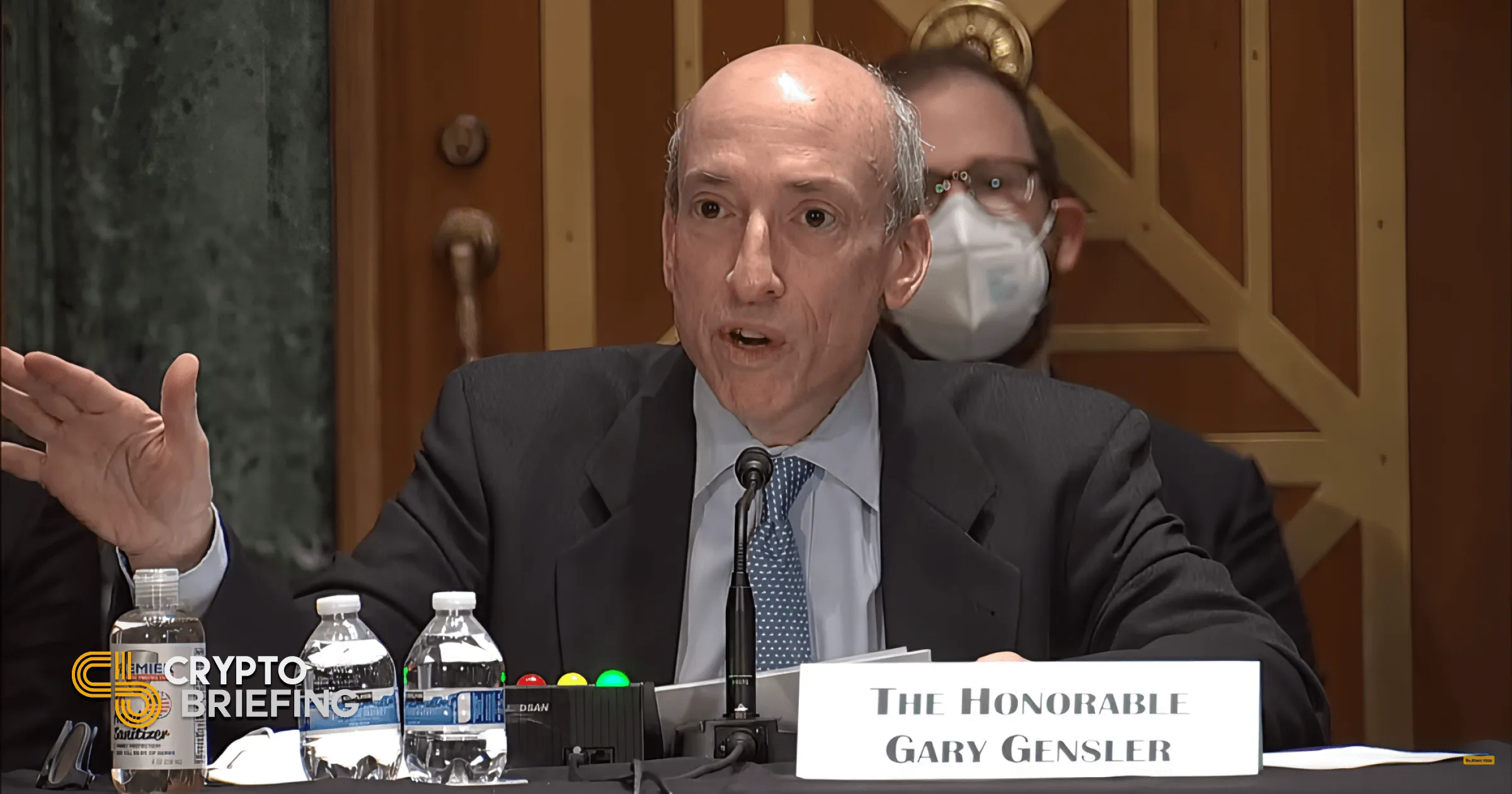

SEC Chair Gary Gensler has recently introduced a proposal that could significantly affect DeFi and cryptocurrency platforms. The proposal aims to extend existing exchange definitions, potentially redefining how decentralized finance applications are viewed under U.S. regulations.

Implications for DeFi Platforms

This new rule could impose rigorous compliance requirements on DeFi services, which are typically characterized by their lack of centralized control. Such regulatory measures may hinder innovation while trying to protect investors.

Key Concerns for Stakeholders

- Investor Protection: Increased regulations aim to safeguard investors but may overwhelm smaller projects.

- Operational Challenges: Many crypto platforms could face significant operational adjustments.

- Market Stability: Changes in compliance could lead to uncertainty in the market.

Potential Outcomes

- Heightened scrutiny of DeFi projects.

- Possible consolidation in the cryptocurrency sector.

- Innovation slowdown due to compliance burdens.

In summary, Gensler’s proposed exchange rule could reshape the landscape for DeFi and crypto platforms. Stakeholders are urged to stay informed as developments unfold.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.